Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

Is a Master’s Degree Worth It?

Earning a master’s degree can be a good thing in so many ways: more knowledge, potentially bigger salary and expanded networking, just to name a few.

Whether you’re just starting to think about getting your master’s or you’re about to enroll, it can help to know that your investment of time, money and energy will be worth it.

Is Grad School Worth the Cost?

Going for your master’s is a big decision with cost being one of them. If you’re like most people, deciding to earn a master’s degree is one of the most significant financial decisions you’ll make.

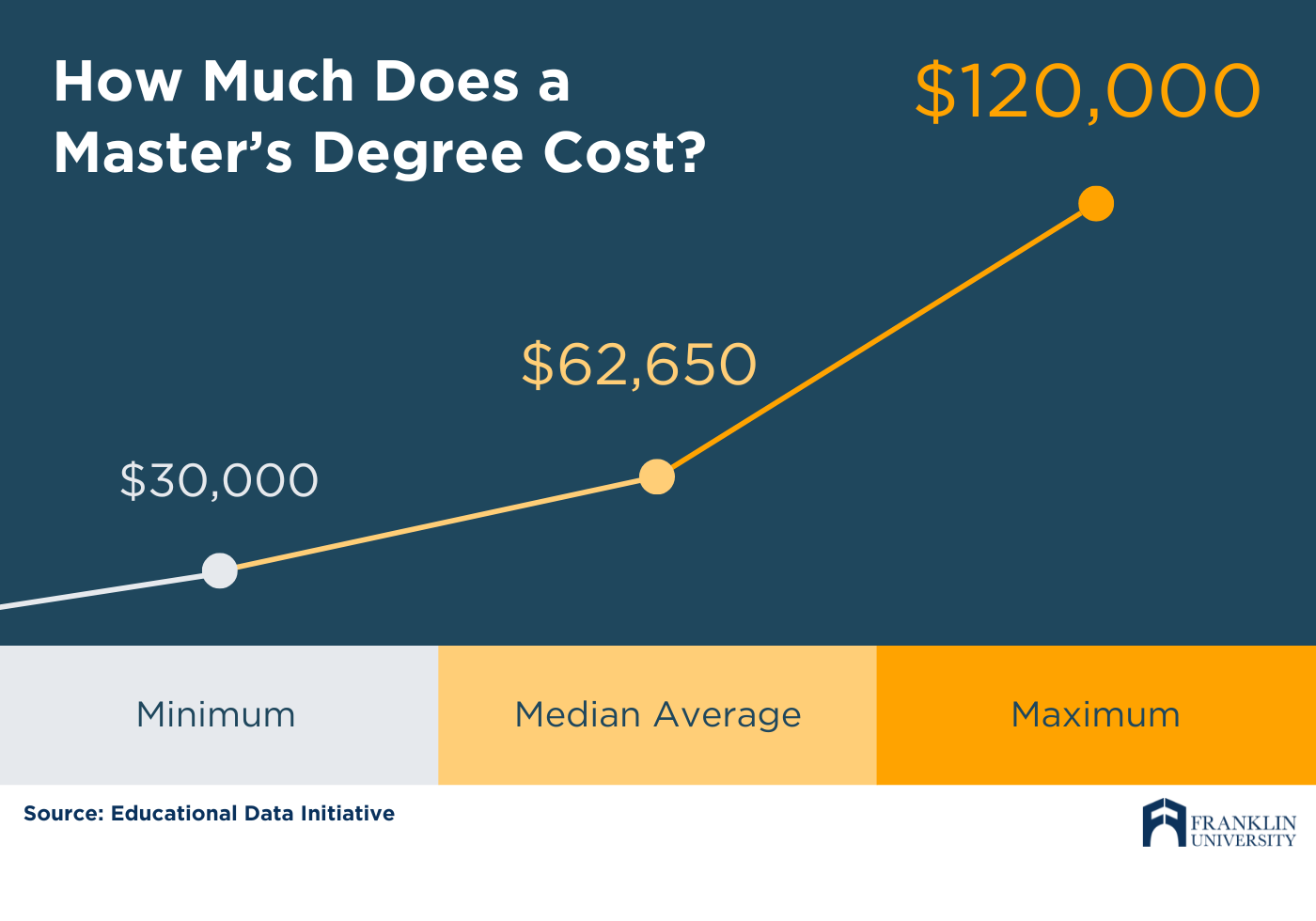

According to the Educational Data Initiative (EDI), the cost of a master’s degree varies by school, area of study and program length but typically ranges between $30,000 and $120,000.

EDI reported the average cost of a master’s degree in 2022 as $62,650. Tuition and fees, of course, vary by institution but you can expect to pay about $29,000 at a public school or around $62,000 at a private university.

7 Questions to Ask Before Deciding If a Master’s Is Worth It

Because a master’s is a significant investment of time, energy, and money, you’ll probably want to take a holistic look at your return on investment before you decide if it’s worth it to you.

Here are seven questions to help you determine the value of your degree to both you personally and professionally.

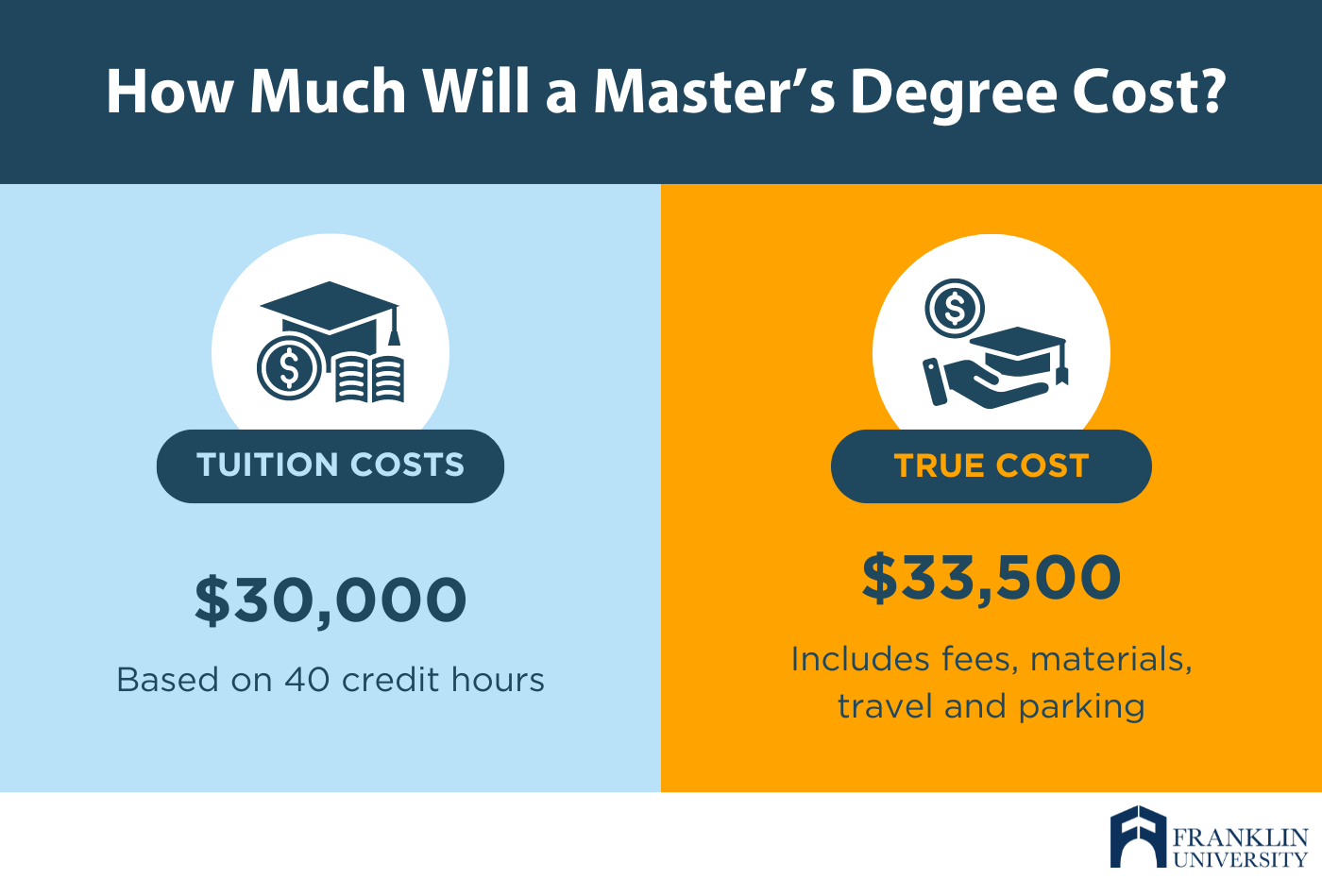

1. “What’s the true cost of my master’s degree?”

It’s a simple enough question, but not so simple to answer. In addition to tuition, there are other costs to consider, such as fees, materials, and student activities and resources. Because these costs vary by school and degree program, be sure to ask your admissions advisor what is–and is not–included. Or, if your school offers a tuition calculator like this one from Franklin University, you could estimate your costs yourself and see how a high-quality degree fits your budget.

According to Rachel Dunphy, M.S., M.B.A., Executive Director of Admissions at Franklin University, “You need to fully understand all of the expenses you may be facing so you can plan your finances ahead of time. Know what you’re getting into with no surprises. That way you can focus on your classes rather than how you’ll pay for them.”

What matters most when choosing a master’s program? Compare features, benefits and cost to find the right school for you.

2. “How much will I have to pay for my master’s?”

When evaluating the actual dollar cost of your degree, don’t forget there are some things in your control that can save you money.

- Scholarships

Ask the financial aid department if you’re eligible for any scholarships, including institutional grants (money that does not need to be paid back). - Transfer Credit

Check with your admissions advisor to find out if you qualify for transfer credit, including credit for certifications, professional training or licenses. Anything that translates into course credit means less you have to pay out of pocket. - Tuition Reimbursement

Talk with your employer about tuition reimbursement. Even if they don’t have a formal program as part of their benefits package, present the case for why investing in you as an employee is worth it to the organization.

3. “Will I have to go into debt for my master’s?”

Knowing how much your degree will cost is one thing, but understanding how much you can afford is something else. A high-priced program (especially if it doesn’t land you a high-paying job) may not be ideal if you have tight finances, a mortgage and a family.

You need to know what is–and isn’t–feasible for you.

“Try taking the same approach with your education as you have with other investments that require you to plan and save,” explains Dunphy. “How did you budget to buy a home and a car, to pay for a wedding, to move to a new city or to have children? What can you juggle in your personal budget? What luxuries can you live without? You’ve already invested in yourself before so use the same planning, discipline and creativity to save and invest in your graduate degree.”

If you must borrow, however, borrow wisely. Don't borrow more than what salary will be once you graduate. You might even want to find an online calculator to help you set some guidelines for borrowing.

“The most important thing,” says Dunphy, “is to have a plan to pay your loans off before you start your degree program. And to try to pay your student loans off early. That way you can reduce the amount of interest you’ll pay.”

4. “What is ‘opportunity cost’ and what does it mean for my master’s?”

Opportunity cost is a way to put a value on what else you’d be doing with your money and your earning potential if you weren’t pursuing a master’s degree. For example, instead of paying tuition, you might be investing that money into a 401K for retirement. As for time, you might be getting overtime, working a second job, or having family fun instead of studying.

The point is, there’s a trade off of time and money that you’ll want to consider.

And don’t forget to include other costs beyond tuition, such as transportation and parking–both of which can add up over the course of many months.

5. “How will my master’s affect my take-home pay?”

You’ll want to calculate the impact of your degree on your take home pay over the course of years, even decades.

According to the U.S. Bureau of Labor Statistics (BLS), education pays.

.png)

The BLS found that those with a master’s degree earn a median annual salary of $86,372 versus $74,464 for those with only a bachelor’s degree. That means a master’s degree can potentially earn you 15% more on average than a bachelor’s degree. And, over the course of a 40-year career, that can add up to an even bigger number: 18.75% more.

The College Payoff, a report from Georgetown University’s Center on Education and the Workforce, found that a bachelor’s degree is worth $2.8 million on average over a lifetime while 61% of those with a master’s degree earn more than the median bachelor’s degree holder.

They also found that those with a master’s degree can expect lifetime earnings of at least twice that of those with only a high school diploma.

6. “What can a master’s do for my career?”

When used as a tool, not a trophy, a master’s degree can help you forge new relationships and business partnerships, earn promotions, and advance your career over the course of many decades.

“I’ve always said that a degree isn’t going to walk down a street, introduce itself to new people, and attend networking events or job fairs. That’s you. Having a graduate degree isn’t about what career opportunities will come to you,” Dunphy says, “it’s about what opportunities you will seek. There is nothing, absolutely nothing, about a master’s degree that is passive. It involves actively understanding what you want, actively participating in your own educational process, and then actively using your degree to open doors.”

7. “What personal rewards can I expect from a master’s?”

The “why” behind earning a master’s is personal. Perhaps you want to learn a new skill or acquire new knowledge. Or maybe you want to get your foot in the door for a particular job or expand their professional network.

Says Dunphy, “It’s hard to know precisely what the personal rewards of a master’s degree program will be but can help to ask yourself this question: ‘How can a master’s degree help me better myself?’ If you think of a graduate program as a goal-setting process, then you can get a better idea of what you can expect.”

Time to Decide

Before beginning the process of earning your master’s degree, it can help to remember that going back to college for your master’s is a big commitment that requires dedication, focus and effort. It’s also a major investment of time, money, and energy that is right up there with buying and renovating a home.

You know you can do hard things and, oftentimes, hard things are worth the effort.

So, ask yourself if this is something you really want. Challenge yourself to consider all sides. And if you decide that going for your master’s is worth it to you, just remember to treat it like the investment it is.