Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

How to Pay for a Master’s Degree: 6 Underrated Strategies

You know a master's degree can be pivotal to your success. You've heard how it can help you advance in your career, potentially boost your salary or make a move into a brand new field.

Have you wondered how you’ll pay for it? You’re not alone. Education is an investment and not having a plan for how you’ll pay to go back to college can make anyone feel a little anxious.

You may be surprised to learn that a master’s degree can be more affordable than you think. Keep reading to learn more about some really do-able strategies you may not have considered, but work.

How Much Does a Master’s Degree Cost?

Unlike a pair of shoes or the latest cell phone, there is no set price for a master’s degree. They cost what they cost–although where you choose to get your master’s has a major impact on what you’ll pay for your degree.

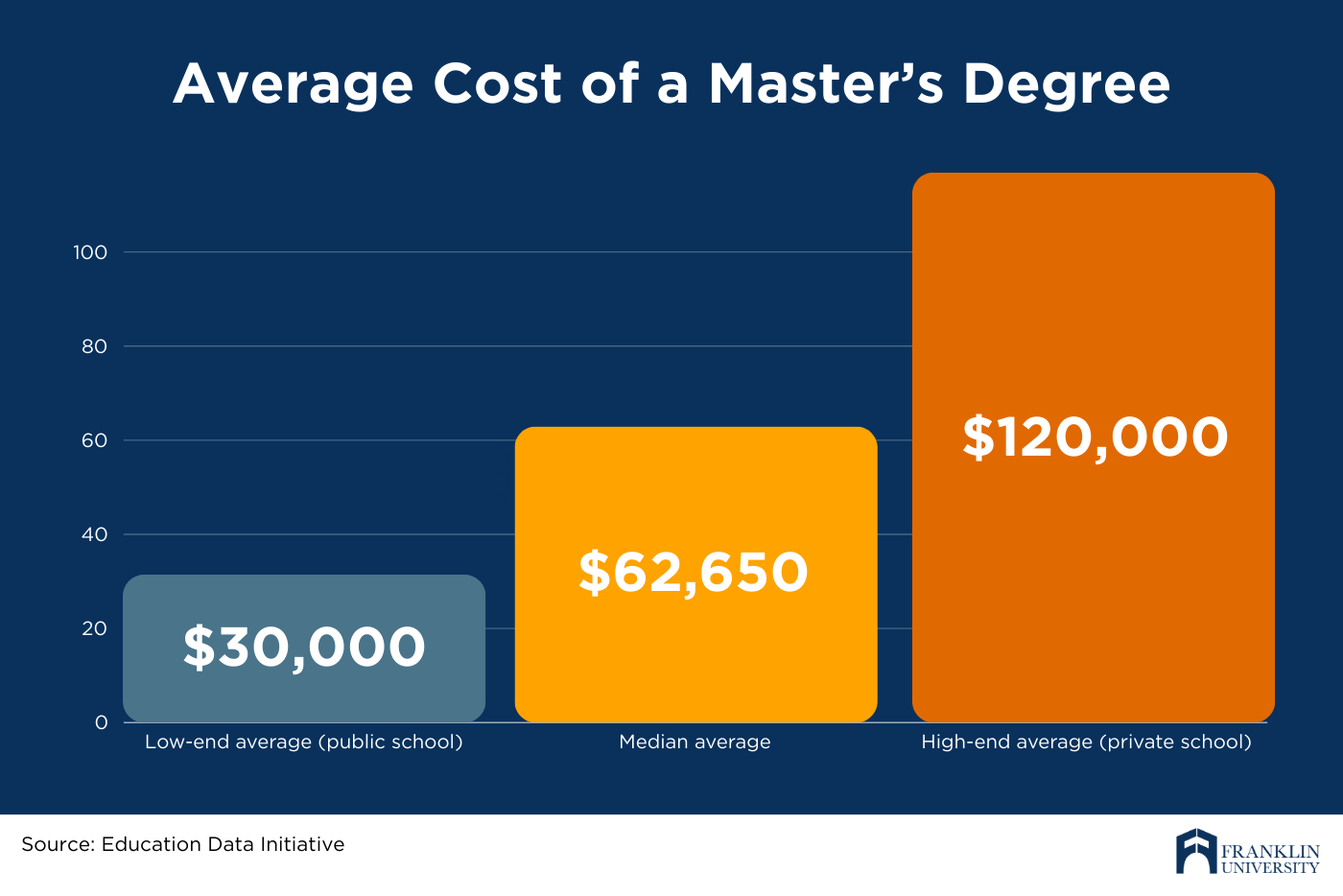

On average, the Education Data Initiative says that a master’s degree will cost you between $30,000 and $120,000. That’s a pretty big range!

The reason being that cost depends on a lot of things, including which school you choose and which degree program you enroll in. There’s also transfer credit to consider, not to mention any tuition assistance benefits you may have from your employer.

The fact is, you’ll need to make some decisions first before you can figure out exactly what you’ll pay out-of-pocket for your master’s degree. Keep reading for a step-by-step guide to doing just that.

Don’t Know How You’ll Pay for Your Master’s? 6 Underrated Strategies to Start Using Today

1. Figure out exactly how much money you need.

Tuition isn’t the only cost involved in earning a master’s degree. There are other expenses, too, like fees and textbooks. You’ll want to get a complete picture of your costs and expenses and subtract them to your income and assets to determine your net costs. That way you’ll know how big of a financial gap, if any, you need to make up with outside funding.

Pro Tip: If you’re not already doing the dreaded B-word, budgeting, start now. A simple budget can give you a more accurate picture of where your money is–and where it’s going.

2. Choose the right school.

The National Center for Education Statistics (NCES) has tracked the average and percentiles of graduate tuition and required fees since the 1989-90 academic year. According to NCES the average yearly graduate tuition cost for 2020-21 ranged from $12,394 for public institutions to $28,445 for non-profit private institutions.

With such a wide range of numbers, it’s even more important to find out what your school’s tuition rate is for the program you’re interested in, so consider these factors before enrolling in a master’s degree program.

- Public or Private Institution

The tuition at a public university typically is less than a private one. But when it comes to public institutions, you’ll also want to consider in-state and out-of-state tuition. You can expect that in-state tuition will save you more than out-of-state costs, which are often as high or higher than a private institution. - On-Campus or Online

An online program could save you money, depending on the college or university. The point is, don’t assume that one is cheaper than another. Do your due diligence by finding out the cost of tuition and fees per credit hour, then calculating the differences to see if an online program can help you save on tuition expenses. - Program Structure

Make sure you know what the graduation requirements are for your master’s program, so you have a realistic view of the full cost of your degree. Keep in mind that most colleges and universities determine their tuition costs on a per-credit rate. That means if your degree program requires you to complete the maximum amount of credits, say 40, you’ll pay more than a degree program that only requires 36 credit hours to complete.

Pro Tip: Online programs usually charge a lower cost-per-credit-hour rate and eliminate some of the miscellaneous fees (like for student activities), which aren’t necessary for working professionals. Because you can keep working, your income won’t be affected.

What matters most when choosing a master’s program? Compare features, benefits and cost to find the right school for you.

3. Apply for state, school and federal financial aid.

Contrary to popular belief, financial assistance is available for graduate school. While there aren’t any federal grant programs (the money you don’t have to pay back), there are some low-interest student loans that may help you afford your master’s degree.

The first step, as always, is to complete the Free Application for Federal Student Aid (FAFSA). This application is administered by the federal government and is used to determine your eligibility for federal and state financial aid programs.

Federal Stafford Loan

This loan should always be your first choice due to its low, fixed-interest rates and origination fees. However, this loan has a lower borrowing limit than others and requires a demonstration of financial need. Check current rates here.

Federal Grad PLUS Loan

Another federal loan, the Grad PLUS Loan, has slightly higher interest rates and fees than the Stafford Loan. However, it has a higher borrowing limit and doesn’t require a demonstration of financial need. Check current rates here.

Institutional Aid

Scholarships and grants can be a great way to afford graduate school. These are offered directly by the college or university and may be based on merit or financial need. Institutional aid varies widely, so be sure to ask your school about available funds.

Work-Study Programs

Depending on your institution, you may be eligible for a work-study study. Unlike scholarships and grants, work-study isn’t given to you–you have to work for it in the form of a paycheck.

Pro Tip: Work-study may not be a viable option for full-time working professionals, but the program is open to graduate students so at least you’re aware in case you need it.

4. Ask your employer and professional associations about funding opportunities.

When it comes to figuring out how to pay for a master’s degree, think about leveraging your career experience and connections. How? Through employer tuition reimbursement programs and industry or professional association scholarships.

Employer Tuition Reimbursement

Pursuing your master’s degree is good for your employer, as much as it is for you. So, ask your HR leader if tuition reimbursement benefits are part of your compensation package. Even if your employer doesn’t have an official tuition reimbursement program, you should present the case for why you’re a good candidate for tuition reimbursement.

Here are some of the most compelling arguments for employer tuition reimbursement:

- You plan to earn your degree while maintaining your current responsibilities. This means that the knowledge and skills you’re acquiring in your degree program can immediately apply to your current role.

- Higher levels of education are proven to increase employee productivity. This means you can take on new projects that can benefit the company’s bottom line.

- You’re learning new, relevant skills. This means you’re preparing to take the lead on projects and advance to a more strategic role, even before you graduate.

Pro Tip: Be sure to share with your employer what degree you want to earn, the institution you plan to attend, as well as a sample agreement outlining the terms and conditions for tuition reimbursement.

Industry and Professional Association Grants and Scholarships

Whatever industry you’re in, there’s likely a scholarship or grant you could be eligible for. Search for scholarships and grants that match your personal background, industry and experience. Start with any professional associations you’re a member of and then branch out to see if there are any other organizations offering free scholarship money. Check out fastweb.com, a free scholarship search platform.

5. Stop sneaky spending.

If you’re serious about getting your master’s degree and staying out of debt, you’ll want to watch your spending. A night out here or there over the year can add up to big dollars–money that could be invested in your education and your future.

Here are a few simple ways you can save money:

- Create a budget (include college expenses, too) and stick to it.

- Eat at home since it’s always cheaper to cook for yourself. Going out for entertainment? Have a meal at home before you go.

- Avoid hidden costs. Cut rarely used subscriptions and unnecessary gym memberships.

Pro Tip: Remember that every dollar you save is one that won’t have to borrow.

6. Borrow only what you need (and have a plan to pay it back).

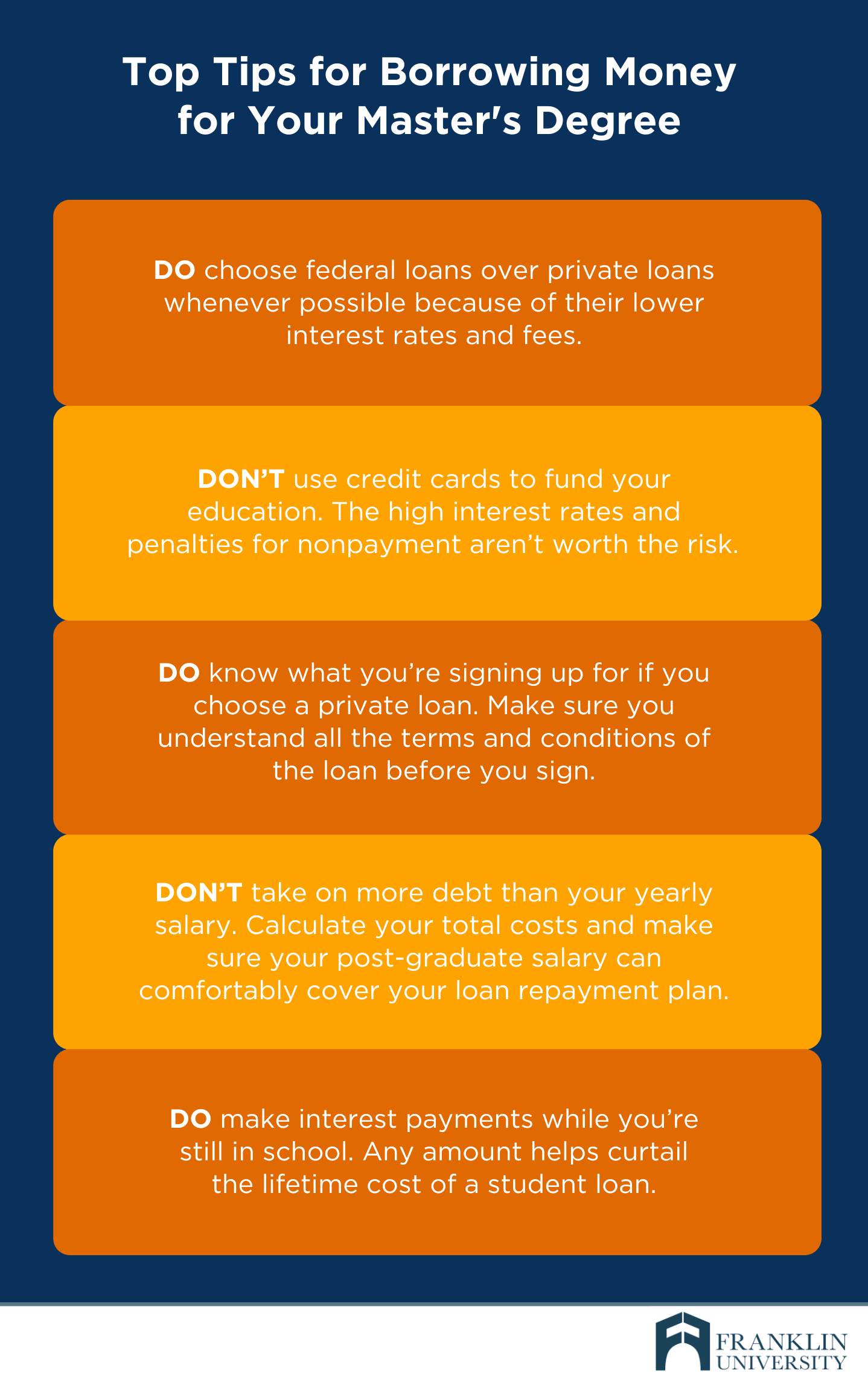

We can’t emphasize this point enough. Look at every possible option before borrowing money to pay for your master’s degree. If you do have to borrow, though, borrow wisely–and have a plan to pay it back.

Here are a few DOs and DON’Ts to help borrow smarter:

Can You Afford a Master’s Degree?

Earning a master's degree while accruing minimal debt is more doable than you might think.

Don’t be afraid to try all of these strategies at the same time, including finding a flexible, online master’s degree program with generous transfer credit policies that can reduce your tuition costs. And do be sure to get a personalized cost estimate that lets you see how much you’ll spend on your degree–and how your costs can change with money-saving and financing options.

You’re smart. You can figure this out. And remember, where there’s a will, there’s always a way–it just might look different than you thought.