Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

Need Help Filling Out the FAFSA? 7 Simple Steps to Get It Right

When it comes to going back to school, tuition costs are a big deal–and, perhaps, a stressful one at that.

The good news is there is over $112 billion (yes, billion) in federal grants, loans, work-study funds and certain scholarships that can help you pay for college.

To become one of the more than 10 million students each year that take advantage of this federal tuition assistance, you must complete the FAFSA® form.

What is the FAFSA Form?

The FAFSA form is an online application that is required to access the largest source of available financial aid–free and low-interest money that can help you pay for college.

FAFSA is an acronym for the Free Application for Federal Student Aid (FAFSA). This application is administered by the federal government and is used to determine your eligibility for federal financial aid programs.

The amount awarded depends on a mathematical equation which is the expected cost of your tuition minus the amount you’re expected to pay for your own college tuition.

Is It Really Necessary for Me to Fill Out the FAFSA?

Yes. To be eligible for student aid you must complete the FAFSA as soon as it becomes available each school year (October 1) and you must:

- Be a U.S. citizen or eligible noncitizen

- Have a valid Social Security number

- Have a high school diploma or equivalent

- Be accepted or enrolled in an eligible degree or certificate program

FAFSA: 4 Types of Financial Aid to Help You Pay for College

1. Federal Pell Grant

This free money is for undergraduate students who have not yet earned a degree and who have an exceptional financial need.

2. Direct Loan

This is a low-interest loan for students who need help covering the cost of their tuition. Direct loans are sometimes known as Stafford loans.

3. TEACH Grant

The Teacher Education Assistance for College and Higher Education (TEACH) provides free money to eligible students who are enrolled in a TEACH Grant-eligible program. Recipients must agree to teach full-time for a minimum of four years in a high-need field at a low-income elementary or secondary school or educational service agency.

4. FWS Program

The Federal Work-Study (FWS) Program helps in-need students find part-time jobs to help pay for college.

5. Scholarships

Some private organizations and schools require the FAFSA as part of their application process, especially for needs-based scholarships. Merit-based scholarships may not require the FAFSA.

How to Fill Out the FAFSA Correctly

While it may seem straightforward, filling the FAFSA is anything but. Worse? Making a mistake on this all-important tuition assistance form can make or break your dream of going to college.

You’re not alone if you’re struggling to understand the FAFSA process or don’t know when or how to file.

This guide can help clear up the confusion so that you can make the most of the benefits you’re eligible to receive.

7 Steps to Ace the Process of Completing the FAFSA

Step 1: Know When to File the FAFSA

If you’re looking for financial aid, you must fill out the FAFSA each and every year you plan to attend college.

The federal government urges students to complete the FAFSA “ASAP” (as soon as possible) to meet federal, state and school deadlines.

When it comes to paying for school, grants are among your best options. But do you know how to find them? Remove the guesswork by downloading this free guide

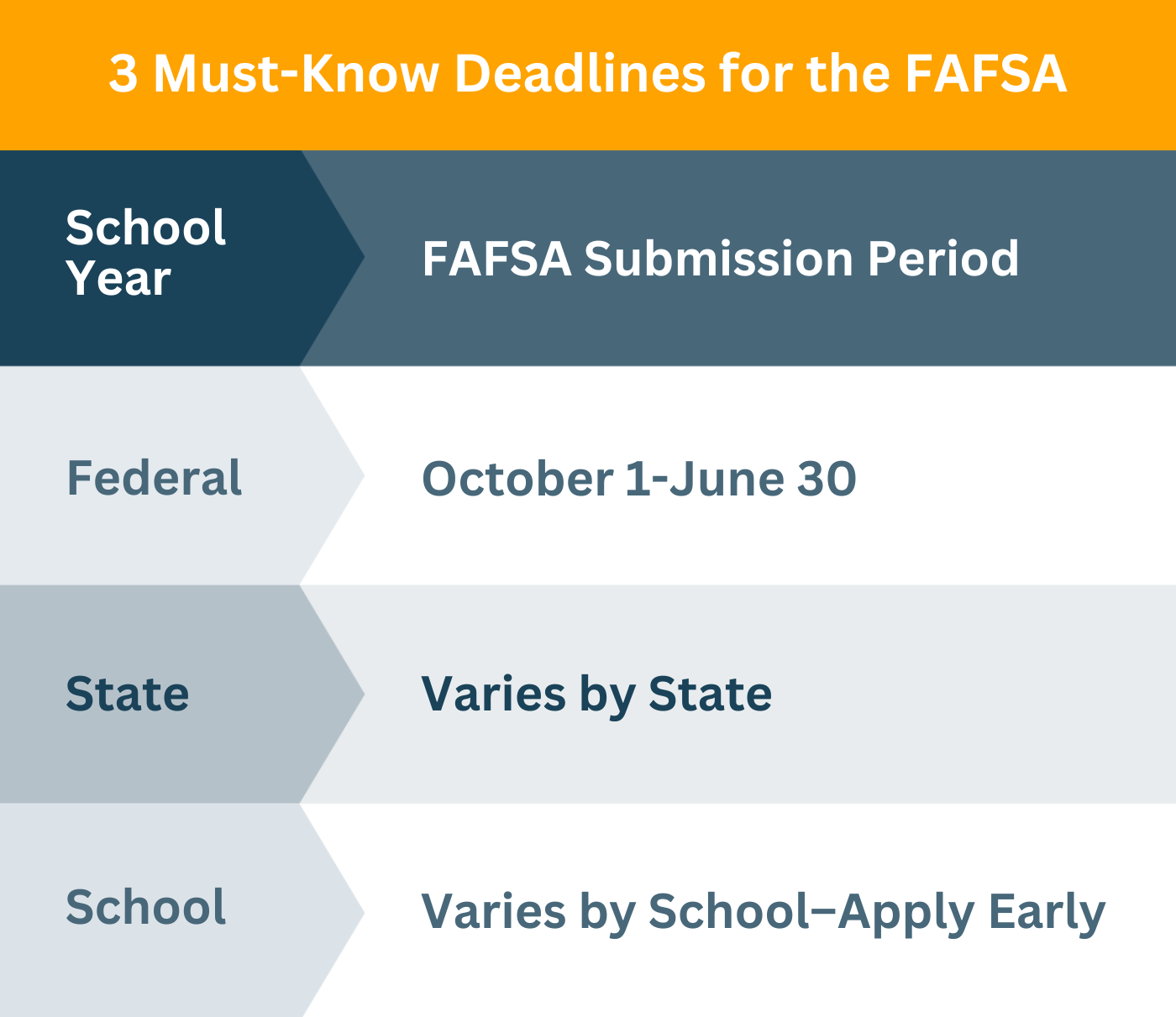

Even though it can be tough to think about three different deadlines–federal, state, and college–there’s no getting around it. States and colleges set priority deadlines and if you miss them, you won’t be considered for those aid programs. The federal deadline for each academic year is pretty easy to remember: It’s always October 1 to June 30 of the following year.

PRO TIP: The old adage about the early bird getting the worm? Well, it’s true. The key to financial assistance success is to apply for the FAFSA early. Most funding is awarded on a first-come, first-served basis so if you’re looking for how to pay for college, it only makes sense to make filing a top priority.

Step 2: Determine Your Dependency Status

Before doing anything, determine if you are an independent student or a dependent by answering yes or no to these questions.

Your dependency status is important for two reasons:

- Dependency status lets you know if you should provide your information on the FAFSA application or someone else’s, such as a parent.

- It plays a part in determining how much financial aid you could receive.

PRO TIP: Make sure you take the time to double check your status. Not living with parents or not being claimed by them on tax forms does not make you an independent student for the purpose of applying for federal student aid.

Step 3: Create an FSA ID

Before you can start the actual process of filling out the online FAFSA, you need to take a few minutes to create an account to manage your student financial aid journey. When you create your account, you’re creating a Federal Student Aid (FSA) identification (FSA ID), too.

The FSA ID is crucial to the FAFSA process because the government uses it to confirm your identity. This is a good thing since it helps prevent fraudulent use of your private information. The FSA ID also acts as your electronic signature for all online federal student aid forms.

To create your FSA ID, you’ll need your Social Security number and your mobile phone number or email address.

PRO TIP: Because the federal government confirms your identity, it can take 1-3 days for your FSA ID to become usable. So, you got it, create your account ASAP.

Step 4: Determine Which Tax Year to Use

You’ll need to report your income from the previous year’s federal tax form. Regardless of your financial situation, you won’t be able to use your current tax-year income on the FAFSA nor update it after filing in the current academic year.

Also, keep your federal tax return handy so you can make sure you accurately report your primary wages, tips and secondary income sources. An inaccurate answer may result in delays or even denial of your FAFSA form.

PRO TIP: You may be able to transfer your tax information to the FAFSA using the IRS Data Retrieval Tool or DRT.

Step 5: Gather Other Documentation and Information

As you complete the FAFSA, you’ll need to answer a variety of personal and financial questions. Having the information on hand can help you to complete the form faster and easier.

IMPORTANT: Use this convenient checklist to ensure you have everything you need before you start completing the online application.

- Social Security number

- Driver’s license number

- Alien registration number (if NOT a U.S. citizen)

- Federal tax returns

- Records for cash and real estate holdings

- Bank account statements

- Investment account records

- Records for untaxed income

Find additional details about these documents here.

PRO TIP: Do not mail these records to anyone, including Federal Student Aid. If you file by mail, be sure to retain your originals and only send copies.

Step 6: Make a List of College Choices

Every college that you list on your FAFSA application will automatically receive your FAFSA information and use it to determine your eligibility for financial aid, including the type of aid and how much you could receive.

You must list at least one school and up to 10 colleges or universities on your online FAFSA application.

PRO TIP: Although listing your preferred universities in a particular order is not important for federal aid, it might be for state aid. You can find detailed state-by-state information on those requirements here.

Step 7: Fill Out the FAFSA Form Online

Once you’ve completed Steps 1-6, you’re ready to go online and complete the FAFSA form. Take your time and be very careful answering questions and inputting data. You don’t want to make any mistakes that could delay your application or, worse, cause a denial. NOTE: Don’t submit your application just yet. Keep reading for more tips.

PRO TIP: Make sure to use your legal name as it appears on your Social Security card. Round up to the nearest dollar when inputting amounts and never leave any field blank. Instead, enter a “0” or “not applicable.”

Tips Successfully Submitting the FAFSA Form

Before you submit your application, check, double-check and triple-check everything. Then check again. Seriously.

Plenty of applications have been denied simply because the applicant entered a wrong name on the form.

FAFSA Form: Avoid These Common Errors

Avoid some of the most common errors by using the online application form rather than a paper one. The online form has skip logic built into it so that you’re prompted to give all the requested information.

- Forgetting to sign and date the FAFSA: Use your FSA ID (username & password) to sign the form and don’t forget to date it, too.

- Using the wrong SSN: Do not make up a number. If you have to, enter 000-00-0000.

- Providing incorrect tax information: Use your federal tax forms, not your W-2s.

- Giving the wrong total: Don’t forget to include yourself in the number of people in your household.

- Inputting temporary address: Always use your permanent address, not a temporary or campus address.

Confused by the FAFSA? Don’t Be.

While filling out the FAFSA may seem like a straightforward process, it’s anything but. Small mistakes or misreporting information may cost you hundreds or thousands of dollars in free money so follow the steps in this article or contact the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243) for answers to your questions.