Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

What Can You Do With a Finance Degree?

Careers in finance are highly sought-after due to their high pay and high growth potential. Jobs for financial analysts alone are expected to grow by 11% through 2026 according to the Bureau of Labor Statistics. But with these desirable positions comes a fiercely competitive field.

The key to a successful finance career starts with getting your foot in the door—which means securing an entry-level position. In this aricle we’ll help you identify promising entry-level jobs for finance degree holders, and give you insight into how you can take your career to the next level once you’ve landed an entry-level job.

Career Paths for Finance Degree Holders

There are two primary career paths for finance graduates: financial management and financial planning.

Managing corporate or government finances and investments

Financial management professionals can expect to work for corporations and conduct financial analysis for the company or work in the investment world. They may also work for the government to manage budgeting and analysis of spending.

Managing personal wealth and estates

Financial planning professionals work with individuals and families to manage their finances at the personal level, such as tax planning, debt management, investment strategy and more.

Within these general career paths are a multitude of jobs. Finding a position starts with knowing what job titles to look for. Let’s take a look at the most common entry-level positions for finance graduates and the types of employers who hire them.

When it comes to paying for school, grants are among your best options. But do you know how to find them? Remove the guesswork by downloading this free guide

5 Entry-Level Jobs for Finance Graduates—Even if You Don’t Have Experience

Financial Analyst

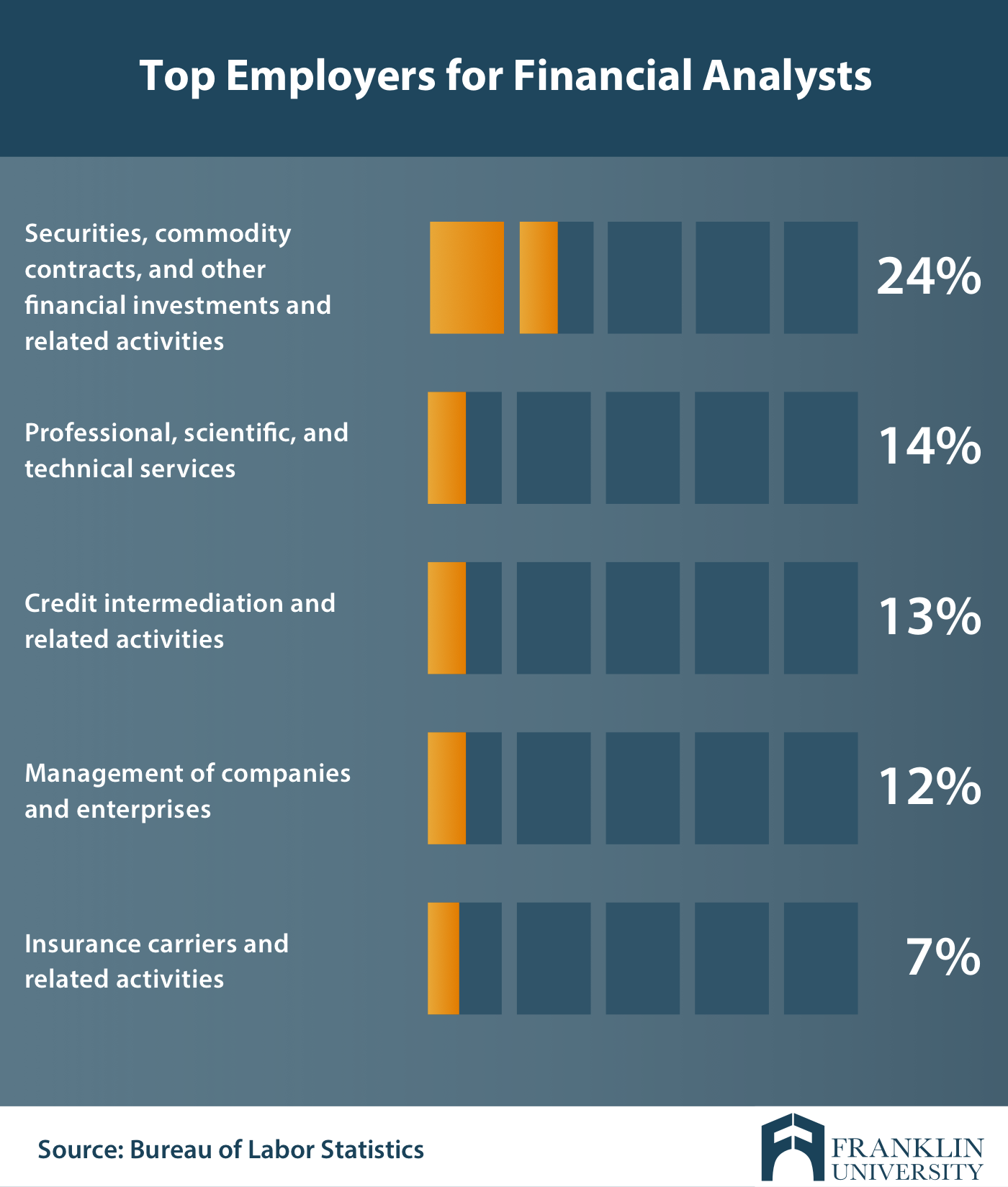

Financial analysts guide businesses and individuals in making investment decisions. They assess the performance of stocks, bonds, and other types of investments to help maximize returns for their employers and clients.

Average Entry-Level Salay: $57,728 (Payscale.com)

2018 Median Pay: $85,660 (BLS)

Personal Financial Advisor

Personal financial advisors work with individuals to provide holistic advice on investments, insurance, mortgages, college savings, estate planning, taxes, and retirement to increase wealth and plan for the future.

Average Entry-Level Salary: $50,351 (Payscale)

2018 Median Pay: $88,890 (BLS)

Loan Officer

Loan officers function as the go-between for financial institutions and borrowers, helping evaluate, authorize, or recommend approval of loan applications for individuals and businesses.

Average Entry-Level Salary: $42,132 (Payscale)

2018 Median Pay: $63,040 (BLS)

Budget Analyst

Budget analysts help public and private institutions organize their finances by evaluating budgets and determining the financial impact of institutional spending.

Average Entry-Level Salary: $53,421 (Payscale.com)

2018 Median Pay: $76,220 (BLS)

Securities, Commodities, and Financial Services Sales Agents

These professionals connect buyers and sellers in financial markets. They sell securities to individuals, advise companies in search of investors, and conduct trades.

Average Entry-Level Salary: $58,535 (Payscale.com)

2018 Median Pay: $64,120 (BLS)

Strengthen Your Skills By Getting Your CFP ®

While you will spend a few years in an entry-level finance position, there are ways to advance your career while getting on-the-job experience. One key way is to prepare for and pass finance industry certifications.

Now considered the minimum standard for finance professionals, getting the Certified Financial Planner (CFP®) designation is essential for increasing your job prospects at leading companies.

To become a CFP® you must meet the standards set by the CFP Board:

- Education: You must develop your theoretical and practical knowledge by completing a comprehensive course of study at a college or university offering a financial planning curriculum approved by the CFP Board.

- Examination: You must pass the comprehensive CFP® Certification Exam, which tests your ability to apply financial planning knowledge to real-life situations, including: the financial planning process, tax planning, employee benefits and retirement planning, estate planning, investment management and insurance.

- Experience: You must have several years of experience delivering financial planning services to clients prior to earning the right to use the CFP® certification trademarks. This practical financial planning experience ensures you can create a realistic financial plan that fits client needs.

- Ethics: CFP® professionals are held to the highest ethical standards, obliged to uphold the principles of integrity, objectivity, competence, fairness, confidentiality, professionalism and diligence.

The CFP designation shows your expertise, but it doesn’t help you stand out as much as it once did. Now, many finance professionals are looking to specialty certifications to distinguish themselves, especially if they are looking to advance their career in a specific financial field.

For additional ways to break into the finance industry as a new graduate, Investopedia offers great insight into entry-level opportunities and how to get your first job in finance.

Deeper Training to Find Your Niche in the Finance Industry

Depending on your career aspirations and desired workplace, the next step for many finance professionals after getting their CFP certification is to demonstrate their subject matter expertise through additional education and certifications.

Here is a list of respected certification options that can help you advance your career.

General Financial Planning

Chartered Financial Consultant (ChFC)

ChFC delves deep into diverse areas of finance such as behavioral finance, small business planning, financial planning for clients in the LGBT community, and more.

Wealth Management

Certified Private Wealth Advisor (CWPA)

Professionals with CWPAs help both individuals and businesses increase net worth, diving deeper into issues like private equity, hedge fund investment and high net worth estate planning.

Investment

Chartered Financial Analyst (CFA)

CFAs are great for investment research analysts and fund managers as they teach you to roll up your sleeves and scrutinize company financials to evaluate stocks and bonds.

Certified Investment Management Analyst (CIMA)

For professionals who are focused on portfolio design, asset allocation, and selecting investment vehicles or investment managers, a CIMA will be greatly beneficial.

Insurance Certifications

Chartered Life Underwriter (CLU)

Gain a deep base of knowledge in life insurance and estate planning to help clients choose the right plans or aid insurance companies in mitigating risk.

Chartered Property Casualty Underwriter (CPCU)

Become an expert in property and casualty insurance for home, automobile and commercial property to help insurance companies manage risk or clients obtain needed coverage.

Retirement

Retirement Income Certified Professional (RICP) Focus on constructing income strategies for clients into retirement, looking at a wide range of approaches—from portfolio-based strategies to annuities and other guaranteed products.

Estate Planning

Accredited Estate Planner (AEP)

In addition to a CFP, this specialization in estate planning will allow you to help clients plan for how their wealth will be distributed after their death.

Chartered Advisor in Philanthropy (CAP)

For professionals who wish to work in ultra-high net worth settings, this designation can help you navigate advanced charitable giving as part of an estate planning strategy.

Taxation

Enrolled Agent (EA)

If you plan to offer tax preparation, an EA will grant you a license by the federal government to prepare individual and business tax returns and represent taxpayers before the IRS.

Certified Tax Specialist (CTS)

Less intensive than an EA, the CTS designation provides an alternative option for a specialty in tax, helping you learn the ins and outs of income tax regulations, credits and deductions.

Get Your Finance Degree for a Successful Start to Your Career

There are multiple options for undergraduate finance degrees, including the B.S. in Financial Planning and the B.S. in Financial Management. Franklin University offers CFP-certified curriculum in both of these degree programs, providing best-practice education from industry professionals that will prepare you for a successful career—whether you want to work in the corporate world or directly with individuals and families.