Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

Top FAFSA Tips and Mistakes to Avoid

Financial aid can make a huge difference in college affordability, but navigating the aid application process and completing the Free Application for Federal Student Aid (FAFSA) can be confusing, especially if you’re applying for the first time.

That’s why Franklin University’s financial aid team rounded up their best tips for completing the FAFSA and maximizing your aid – as well as common mistakes to avoid.

What Is the FAFSA?

The Free Application for Federal Student Aid (FAFSA), which is administered by the U.S. Department of Education, is used to request federal grants, work-study and loans. It asks questions about your income, bank accounts and other assets and residency status. If you are a dependent student, you will also answer questions about your parents’ or guardians’ financial situation. If you are married, you will also include financial information about your spouse. You can complete the FAFSA online or on paper, though completing it online is easier and safer.

You’ll need to complete the FAFSA every year you apply for financial aid. However, it’s simpler to complete after the first time since you can carry over some information.

Why Does the FAFSA Matter?

If you want help paying for college, completing the FAFSA should be your first step. This application is used to determine your eligibility for federal financial aid, as well as for institutional grants and state funding.

Students who complete the FAFSA receive a Student Aid Report (SAR), which is automatically sent to the colleges and universities they apply to, as well as state funding agencies. Those schools and institutions use that information to build financial aid packages. That means that if you need help paying for college, completing the FAFSA correctly and on time is essential.

When it comes to paying for school, grants are among your best options. But do you know how to find them? Remove the guesswork by downloading this free guide

Common FAFSA Mistakes to Avoid

The FAFSA asks for a lot of information; if you’re unfamiliar with the process, it can be difficult to navigate. Avoiding these common mistakes can save you time and help you get the most funding you can.

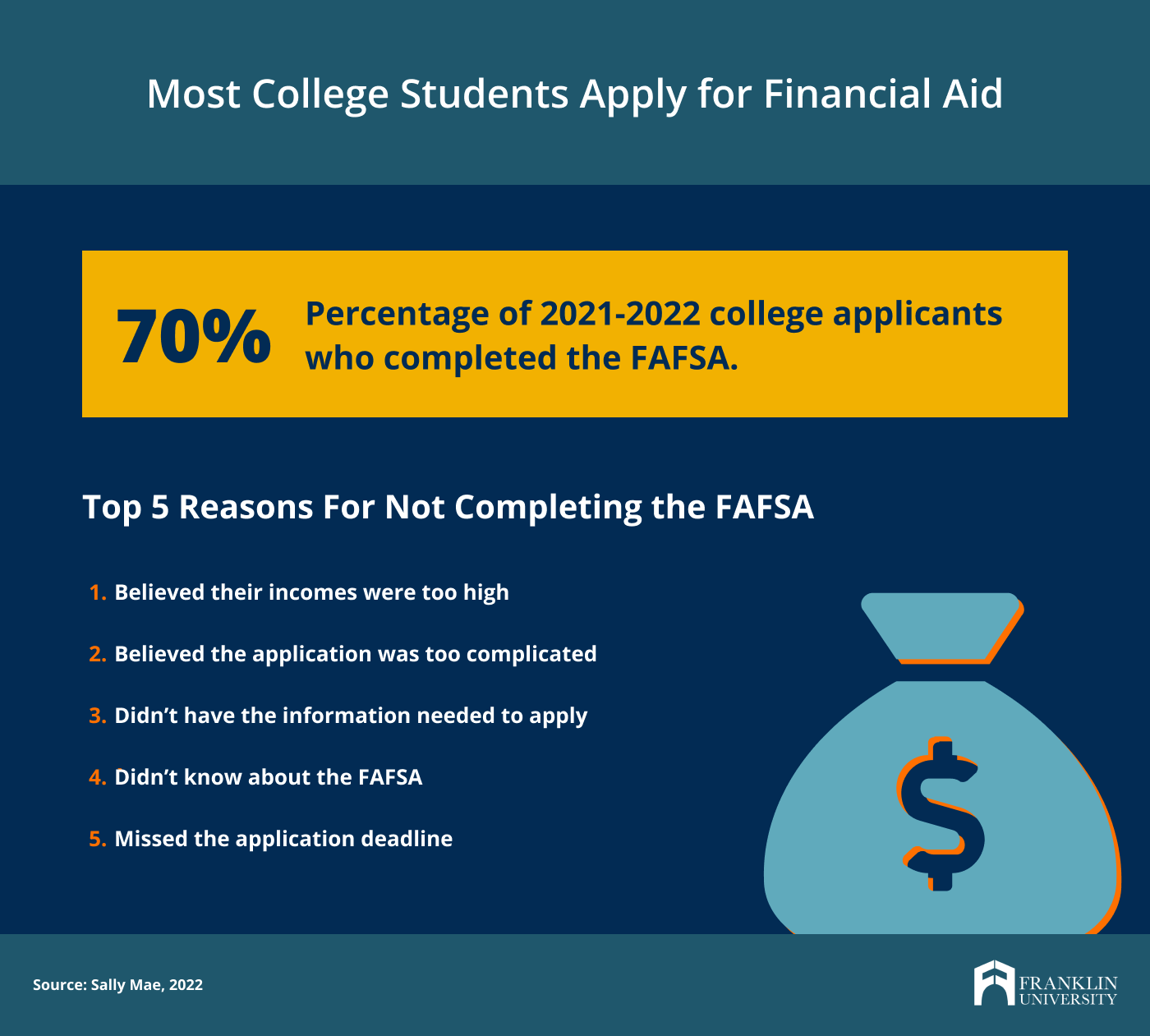

1. Assuming you aren’t eligible for aid

Even if you aren’t struggling financially, you may be eligible for some forms of financial aid – and there’s no harm in applying to find out.

“The best way to determine your eligibility for aid is to complete the FAFSA,” says Lea Mederer, director of financial aid processing at Franklin University. “Most students at least qualify for loans to help cover the cost of tuition, books and fees.”

2. Not signing up for a Federal Student Aid (FSA) ID early

Before you can file your FAFSA, you’ll have to create a Federal Student Aid ID account with StudentAid.gov. If you are classed as a dependent student, your parent will also need their own FSA ID. Once you’ve created an account, it can take a few days for it to sync with IRS data before you can log in, so it’s smart to make one early in the application process.

3. Waiting to file

While FAFSAs are accepted on a rolling basis, each school and state sets their own priority deadlines. Filing your application before that priority date gives you the best chance of receiving limited funds and gives you time to sort out any issues before you start school.

“Waiting until the last minute may result in delays, late fees or losing out on available funding that has deadlines,” said Mederer.

4. Not understanding your dependency status

When it comes to financial aid, “dependent” and “independent” have different meanings. Even if you aren’t receiving financial support from your parents, you may still be classified as a dependent student.

To be classified as independent, you must be at least one of the following:

- More than 24 years old

- Married

- A graduate or professional student

- A veteran

- A member of the armed forces

- An orphan

- A ward of the court

- Someone with legal dependents other than a spouse

- An emancipated minor

- Someone who is homeless or at risk of becoming homeless

If you do not meet at least one of those criteria, you must also submit your parents’ financial information when applying for financial aid.

5. Not understanding who is in your household

The size of your household is used to determine how much of your income (or your parents’ or guardians’ income) is available to pay for college. Your household isn’t necessarily made up of the people you actually live with.

If you are an independent student, your household includes:

- You

- Your spouse (unless separated or divorced)

- Your children (if they will receive more than half of their support from you during the award year, whether or not they live with you)

- Other people who will live with you and receive more than half of their support from you during the award year

If you are a dependent student, your household includes:

- You (whether or not you live with your family)

- Your parents (only the custodial parent is counted if your parents are divorced)

- Your siblings (if they receive more than half of their support from your parents, whether or not they live with your parents)

- Your children (if they receive more than half of their support from your parents, whether or not they live with them)

- Other people who will live with your parents and receive more than half of their support from you during the award year

6. Listing the wrong amount of income

Don’t use your total earnings (or your parents’) when filling out the FAFSA. Instead, report your adjusted gross income (AGI), which subtracts things like retirement contributions and student loan interest. You can get this number from your tax return.

7. Including assets that should be excluded

The FAFSA asks about your net worth, including investments. However, you should not report any retirement accounts or the value of your residence (if you own it). That’s because those aren’t assets you can reasonably access to pay for college.

8. Not listing all colleges you’re applying to

If you’re applying to multiple schools, be sure to include every school’s code on the FAFSA to ensure that they all receive the information they need to create a financial aid offer for you.

You can find a list of school codes through the Department of Education or by looking at each school’s financial aid page.

9. Paying for submission

Watch out for fake websites pretending to be the FAFSA – you should only use the official government website that ends in .gov.

“Filing the FAFSA is free,” explains Mederer. “If someone is asking you to pay to complete it may be a scam.”

Tips to Get the Most from the FAFSA

Fortunately, there are plenty of ways to make the process easier and increase your chances of receiving all the aid you’re eligible for.

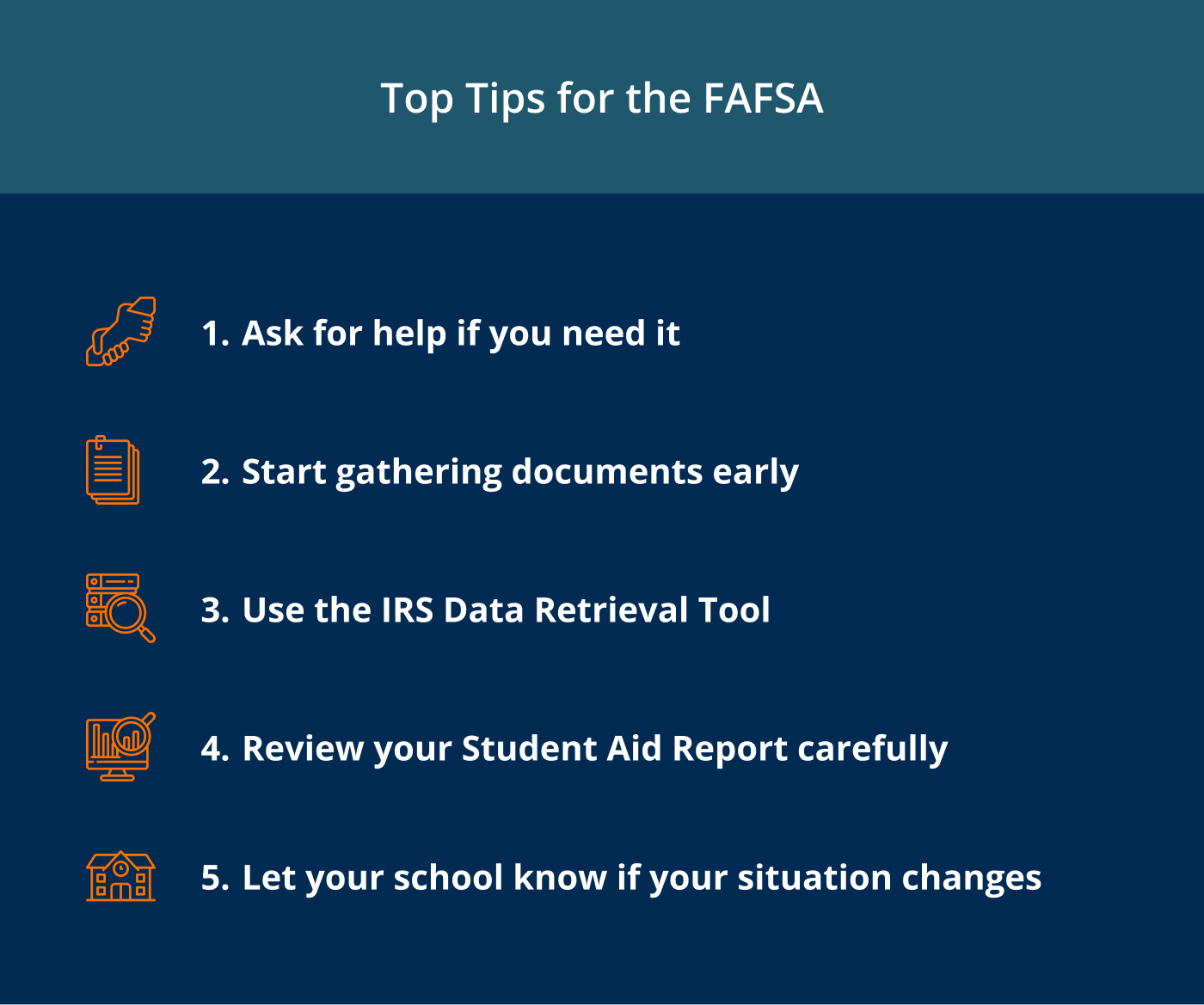

1. Ask for help if you need it

“Don’t be afraid to ask questions,” says Mederer. “Things change from year to year, and even simple questions can have different answers depending on the award year. We’re here to help. Call in to talk to Franklin’s Student Financial Services team about the process or schedule an appointment for a more in-depth review of your circumstances.”

2. Start gathering documents well in advance

Don’t wait until the last minute to find the documents you need. Remember, you’ll need your tax return and documentation of all of your cash, checking, savings and investment accounts. If you are a dependent student, you’ll also need that information for your parents.

3. Link your FSA to your IRS Data Retrieval tool to help you get essential info and avoid mistakes

The fastest and easiest way to fill out the FAFSA is to use the IRS Data Retrieval Tool (DRT), which connects your FAFSA account to your tax data. This can save a lot of time and reduce the potential for error. However, it won’t fill in all the fields you need, and you should double-check that everything looks correct carefully.

4. Review your Student Aid Report (SAR) carefully

A couple of weeks after you file the FAFSA, you’ll be notified that your SAR is available. This is the report on your financial ability to pay for school that’s shared with schools and outside organizations, like state governments, that control funding. Check your SAR carefully to ensure there are no mistakes and that the information you shared is still accurate.

5. Let your school know if your situation has changed

Since your FAFSA application depends on tax information that’s two years out of date, the income it shows may not match your current reality.

If your circumstances have changed – for example, you or a parent has lost a job, a key earner has passed away, or someone in the family has large medical expenses that aren’t covered by insurance – let your school know. They can file a “special circumstances” appeal to adjust the amount of aid you are eligible for.

Franklin’s Student Financial Services team is happy to discuss the process and share more information.

Have Questions? The Franklin Student Financial Services Team is Here to Help

In addition to offering competitive undergraduate tuition of just $398 per credit hour, Franklin University is committed to helping you apply for and receive as much financial aid as possible. Plus, Franklin’s flexible schedule and online options can help you minimize the cost of your degree.

If you have any questions at all about affording college or how to apply for financial aid, don’t hesitate to contact us. And if you’re applying for aid, don’t forget to include Franklin’s school code, 003046, on your application.