Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

Accounting Career Paths: How to Choose Which Is Right For You

Many people assume accounting is a one-dimensional field. However, as technology advances and businesses become more complex, the role of accountants is dynamic. Accountants are no longer number crunchers. They are strategic advisors that have a bottom-line impact on the health of a business.

It’s no surprise that the demand for accountants will continue to grow. According to leading labor market analytics firm EMSI, there were over 1.3 million accounting jobs in 2021. That number is expected to grow by 6.1% over the next 10 years to over 1.4 million jobs.

Many who are considering accounting may be surprised by how broad the field can be. This article will help you understand the major paths that accountants take in their careers—public accounting and private accounting. After choosing the workplace that best suits your skills, interests and goals, there are also specializations and alternative career paths you can consider.

Let’s walk through each option to give you a clearer picture of what your career as an accountant could look like.

Career Path 1: Public Accounting

Public accountants are not employed by any single client, which means they are not part of the client's internal corporate structure. Public accountants are hired as outside experts who can provide a range of accounting services—from advisory and tax to audit services.

People often choose the public accounting path because they enjoy the challenge of working on multiple accounts. They thrive in a fast-paced environment that gives them the opportunity to learn about new industries and solve myriad challenges. Public accountants will also need to earn their CPA license in order to advance past entry-level positions.

The work environment in a public accounting firm is:

- Fast-paced and rigorous: No two days are exactly the same. Public accountants will need to balance the priorities and deadlines of multiple clients, while being responsive to immediate client needs.

- Diverse: From the types of clients you serve to your internal teams and day-to-day responsibilities, your role will be constantly evolving. For example, you may have a client in the healthcare industry, while another specializes in financial services. You will need to be well-versed in general accounting best practices and be able to apply that expertise seamlessly across industries.

- Demanding: Long hours and frequent travel are the norm in public accounting firms.

Public accounting roles are the best fit for accountants who:

- Want to earn their CPA: You need to have a comprehensive plan to meet the requirements for earning a CPA, including passing the difficult CPA exam. A CPA is essential to move to management positions in public accounting firms.

- Stay organized: Public accountants need to be detail-oriented and deadline-driven professionals who can stay on task with little supervision.

- Make flexibility a priority: These roles require you to be adaptable and require a lot of hustle, but they can pay off in the long run.

Accountants who pursue the public accounting path will experience career advantages such as:

- Learning rapidly: Measuring the experience of public accountants in years doesn’t do the work justice. Long hours and diverse clients lead to public accountants constantly advancing their skills and gaining new expertise.

- Advancing quickly: Public accountants typically spend 1-2 years in entry-level positions before moving up the ladder.

- Transitioning seamlessly: After gaining experience at a public accounting firm, accountants can move into an industry role at management levels. This is a popular route for accountants who want better work/life balance.

A popular career path for aspiring public accountants is to land a prestigious opportunity at one of the “Big Four” accounting firms. The Big Four firms include Deloitte, Ernst & Young, KPMG and PricewaterhouseCoopers (PwC), which account for over one million accounting and auditing jobs across the world. There are also smaller, regional public accounting firms that often find a niche in an industry, such as healthcare or finance.

.

Career Path 2: Private Accounting

Private accounting, also commonly referred to as industry accounting, is a career path that involves working for a single organization within its internal finance department. Private accounting is focused on the inner workings of businesses, governments and agencies.

Professionals choose the private accounting path if they are looking for strong work/life balance, a consistent and predictable schedule, and the ability to focus on a single organization’s finances. They are also not required to earn a CPA license, although it may be beneficial for certain opportunities, such as positions in government agencies.

The work environment for private accounting roles is:

- Consistent: Day-to-day responsibilities are dependable, focusing on a single company’s operational costs and evaluating its fiscal performance.

- Supportive: Managers and team members are typically the same across assignments, making private accounting workplaces collaborative and encouraging.

- Lower stress: Deadlines are more predictable, office hours are standardized and travel, if required at all, is limited.

Private accounting roles are the best fit for accountants who:

- Seek work/life balance: If you want to work a consistent 40-hour week, private accounting is more likely to offer a steady schedule.

- Want depth of experience: Private accounting roles offer the opportunity to delve into the financial requirements of a specific industry and company to grow niche expertise.

- Prefer stability and longevity: Due to the limited size of financial departments, advancement opportunities may not come as quickly for industry accountants, especially if they want to stay with the same employer.

Accountants who pursue the private accounting path will experience career advantages such as:

- Reaching the management level without a CPA: While public accounting requires a CPA to advance, industry accountants may find that a CPA is optional for advancement to management positions.

- Experiencing greater job satisfaction: By working for a single organization, accountants are able to see the direct impact of their work and the long-term effect they have on the business.

- Linear career progression: If an accountant is interested in staying within an industry, it’s easy to map out the long-term career path and the milestones one will need to achieve in order to advance.

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

Five Popular Specialization Paths for Accountants

As your accounting career progresses, you have the opportunity to specialize within different accounting disciplines. Whether you choose the public or private accounting path—or switch between the two—specializations can help you qualify for new positions and advance your career.

Let’s look at five popular specializations, how these roles differ, and the education and/or credentials that are beneficial for growing your expertise.

Tax Accountant

These professionals help individuals and organizations file their taxes, take advantage of deductions and credits, avoid audits, and receive the maximum available return.

- Level Up Your Education: A master’s degree program is a great way to gain specialized tax expertise. For example, Franklin University offers an M.S. in Accounting with a focus area of taxation. Focus area curriculum helps you gain expertise in individual, corporate, pass-through entity and federal tax practices.

- Earn Professional Credentials: A CPA license or an Enrolled Agent (EA) credential can both be beneficial for a career in taxation. An EA credential recognizes professionals, including CPAs, licensed by the government to represent taxpayers. The EA designation is assigned by the IRS, and candidates must pass a three-part comprehensive test covering individual and business tax returns.

Financial Accountant

Financial accountants are responsible for evaluating their company’s financial performance. These professionals create reports for external parties, as well as serve as consultants to senior managers.

- Level Up Your Education: A master’s degree in accounting is also an ideal path for accountants wanting to focus on financial performance. Financial operations is another focus area offered by Franklin University to help students gain expertise in enterprise resource planning, advanced auditing and corporate risk analysis.

- Earn Professional Credentials: If you want to work in an investment firm or elevate to the role of senior finance manager or CFO, a Certified Financial Analyst (CFA) designation can help you climb the corporate ladder. The CFA designation verifies your knowledge and skills regarding portfolio management, economics, professional and ethical standards and investment analysis

Government Accountant

A specialization within public accounting, government accountants manage the financial records of local, state, and federal government agencies and make sure these bodies follow regulations when collecting and spending funds. They may also audit private organizations and individuals subject to tax regulations.

- Earn Professional Credentials: A CPA license will be highly beneficial for a specialization in government accounting because it authorizes you to provide audited financial statements to government agencies. An EA designation is also beneficial, as it certifies you to represent your organization in ongoing relations with the IRS.

Management Accountant

Management accountants help companies make better financial decisions by creating budgets, planning for business costs, supervising investments, and developing strategies to enhance performance.

- Earn Professional Credentials: There are two popular certifications for management accountants. The first is the Certified Management Accountant (CMA) designation, which certifies competency in cost management, decision analysis, forecasting and internal control auditing. Many professionals pursue this certification in addition to a CPA. The second is the Chartered Global Management Accountant (CGMA), which verifies your skills and expertise in developing all-encompassing business strategies. This is also commonly an add-on to a CPA license.

Auditor

Auditors examine a company’s financial activities to ensure it properly manages revenue and adheres to internal policies and external regulations. They also help create strategies that minimize risk in areas such as cybersecurity and data storage.

- Earn Professional Credentials: There are two professional certifications that can help you advance your career in the auditing specialization. The first is the Certified Internal Auditor (CIA) designation, which is the only internationally accepted distinction for professionals who want to pursue an internal auditor career. A CIA recognizes risk and control competencies, as well as information technology. Professionals in the audit specialty may also choose to earn a Financial Services Audit Certificate (FSAC), which is beneficial for professionals seeking a career in audit, fraud and risk management. This certification dives deeper into subjects such as cybersecurity and fraud risk assessment, as well as auditing within financial services, insurance and banking industries.

Alternative Careers for Accountants

If you get an accounting degree, it doesn’t mean you have to have “accountant” in your job title. There are many career opportunities in finance and beyond for professionals who earn their accounting degree.

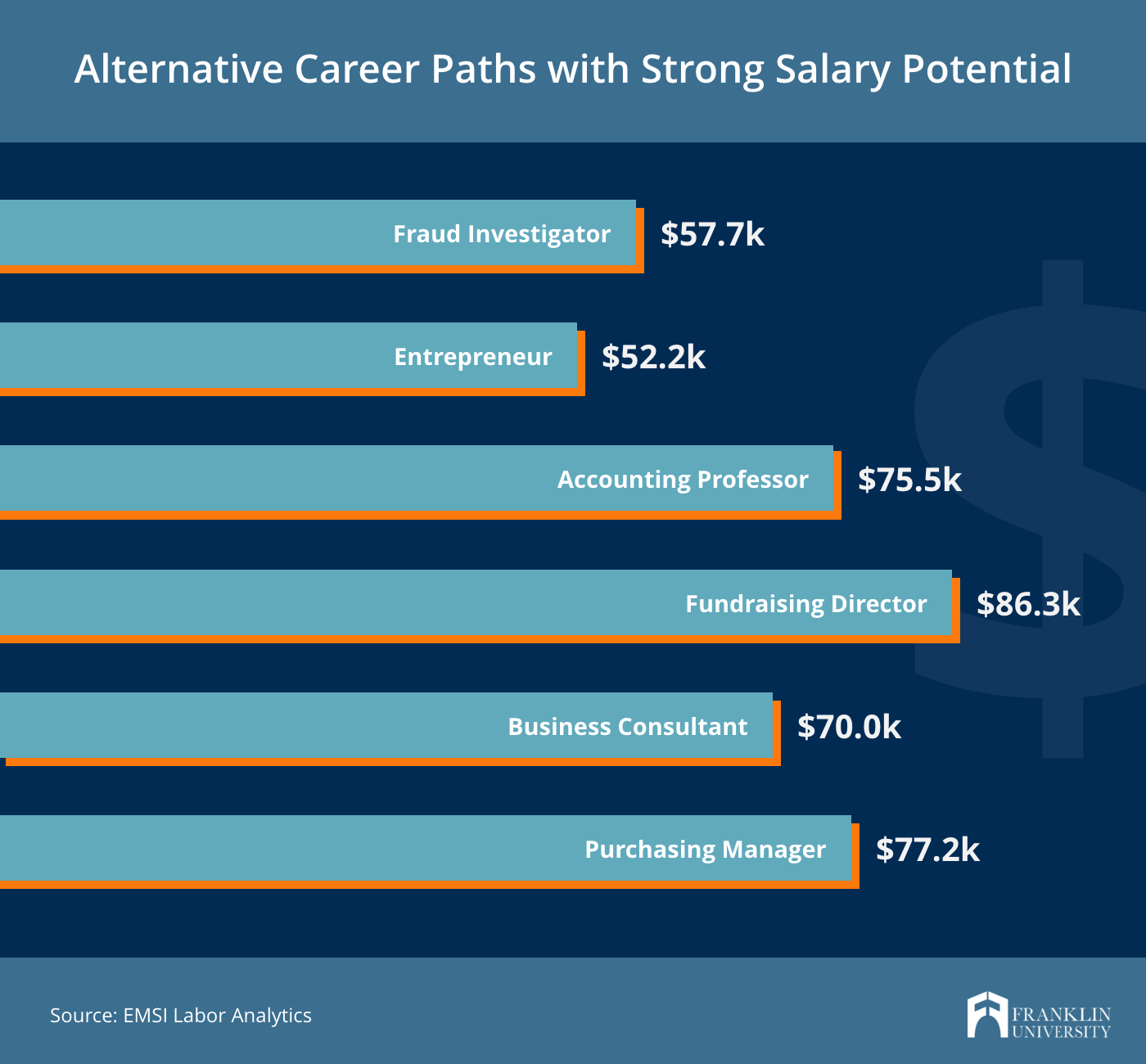

Here are six interesting careers that a bachelor’s degree in accounting can prepare you for:

- Fraud Investigator | $57.7K: Fraud investigators review allegations of suspected financial fraud. Their responsibilities include interviewing individuals with information about the suspected crime, analyzing relevant documentation, and reporting their findings. For accountants interested in investigative and legal work, this career provides the best of both worlds.

- Entrepreneur | $52.2K: Entrepreneurs develop products and services, create business plans to monetize their ideas, and manage operations of their business. The financial acumen of an accountant can set them up for success ensuring the profitability of business ventures.

- Accounting Professor | $75.5K: Accounting professors are responsible for conveying their expertise in accounting to the next generation. Responsibilities include developing curriculum, teaching courses, advising students, and reviewing student work. Accountants with significant experience may find this career path rewarding and a nice change of pace from typical day-to-day responsibilities of a practicing accountant.

- Fundraising Director | $86.3K: Fundraising directors develop fundraising targets and strategies for soliciting gifts from individuals, businesses, foundations, and other organizations. This can be an ideal career path for accountants with strong people skills who want to combine their financial prowess with mission-driven work.

- Business Consultant | $70.0K: At a high level, business consultants analyze organizational practices, identify challenges and recommend solutions. For accountants with outgoing personalities who love solving complex problems, this career can put both technical and interpersonal skills to work.

- Purchasing Manager | $77.2K: Purchasing managers oversee an organization’s acquisition of products, equipment and services. This strategic role ensures an organization can meet supply requirements, operate efficiently and maintain competitive pricing in the marketplace. Accountants with strong critical thinking and negotiation skills will thrive in this role.

Choose the Accounting Program that Will Put You on the Right Path

The first step to a flourishing accounting career is choosing the right accounting degree program.

Franklin University offers an online bachelor’s degree in accounting that helps working adults earn a degree on their schedule. Franklin’s B.S. in Accounting faculty have in-depth industry experience and will teach you accounting best-practices using the latest technology. Plus, Franklin allows you to transfer up to 76% of the credit you need to graduate.

Explore how the B.S. in Accounting program will prepare you for a rewarding accounting career.