Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

Accounting & Data Analytics: What You Need To Know

Companies today have access to more information than ever before. In fact, SeedScientific estimates that every day 2.5 quintillion bytes of data are generated. But what does that mean for an accountant?

It means opportunity.

Companies need strong accounting leaders to translate their portion of that data into valuable insights that can help a company improve business outcomes and adjust to changing sales patterns all in real-time.

Collecting and collating large amounts of data takes time, discipline and a certain set of skills. These skills can be found in an accountant with a background in data analytics. Their knowledge and experience enables them to dive deep into the data and extract the value in it.

As the amount of available information increases so does the need to have skilled accountants who can analyze and contextualize it, which puts a particular importance on the need for accountants with strong data analytic skills.

What Is Data Analytics in Accounting?

Data analytics are used by accountants to do things like discern patterns in customer spending, identify market behavior, anticipate trends and predict regulatory reactions.

Accountants who specialize in data analytics manage, analyze and mine multiple streams of data. Doing so provides them granular-level details that can be used to answer questions, identify patterns and make fact-based predictions.

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

Using data analytics, accountants can help a company:

- Evaluate Performance: The performance of every area of the business can be evaluated using predetermined metrics. An accountant may look at revenue data, quarterly goal performance or production numbers.

- Mitigate Risk: Areas of current or potential risk can be uncovered and managed in real-time. Funding needs, process flows and investment opportunities are all areas that an accountant may look at.

- Understand Behaviors: Tracking and reviewing consumer and internal behavior patterns and employee productivity waves enable accountants to drive business decisions and growth plans.

- Build Business Plans: With a detailed understanding of past and present business patterns, a company can confidently make plans for its future. An accountant would look at factors like historical sales numbers, employee retention patterns, organizational spending and equipment life-cycles.

- Structure Business Improvements: When an area of the company isn’t performing up to expectations, data analytics can pinpoint where improvements might be needed. In order to create an effective strategy, an accountant may review sales forecasts, historical sales performance numbers and operating costs.

- Find Opportunities: Opportunities to grow and develop a competitive advantage can be uncovered by analyzing past performance and looking at current trends. These include operational capabilities, current customer breakdowns and market patterns.

- Maximize Profits: With the clear insight that data analytics can provide, a company can make decisions that will build up their bottom line. To help with this, accountants will look at a number of data points including past purchasing behaviors, current market trends, inventory management and customer orders.

4 Types of Data Analysis for Accountants

Forbes believes that by harnessing big data, accountants “...could leverage data management tools, including augmented reality, to humanize and contextualize spend data for the C-suite to make better decisions based on long-term value rather than return on investment alone.”

A skilled accountant can use analytics to move companies from using static representative samples in their decision making to a continuous data-monitoring model which provides a holistic view and empowers them to make more accurate and timely decisions.

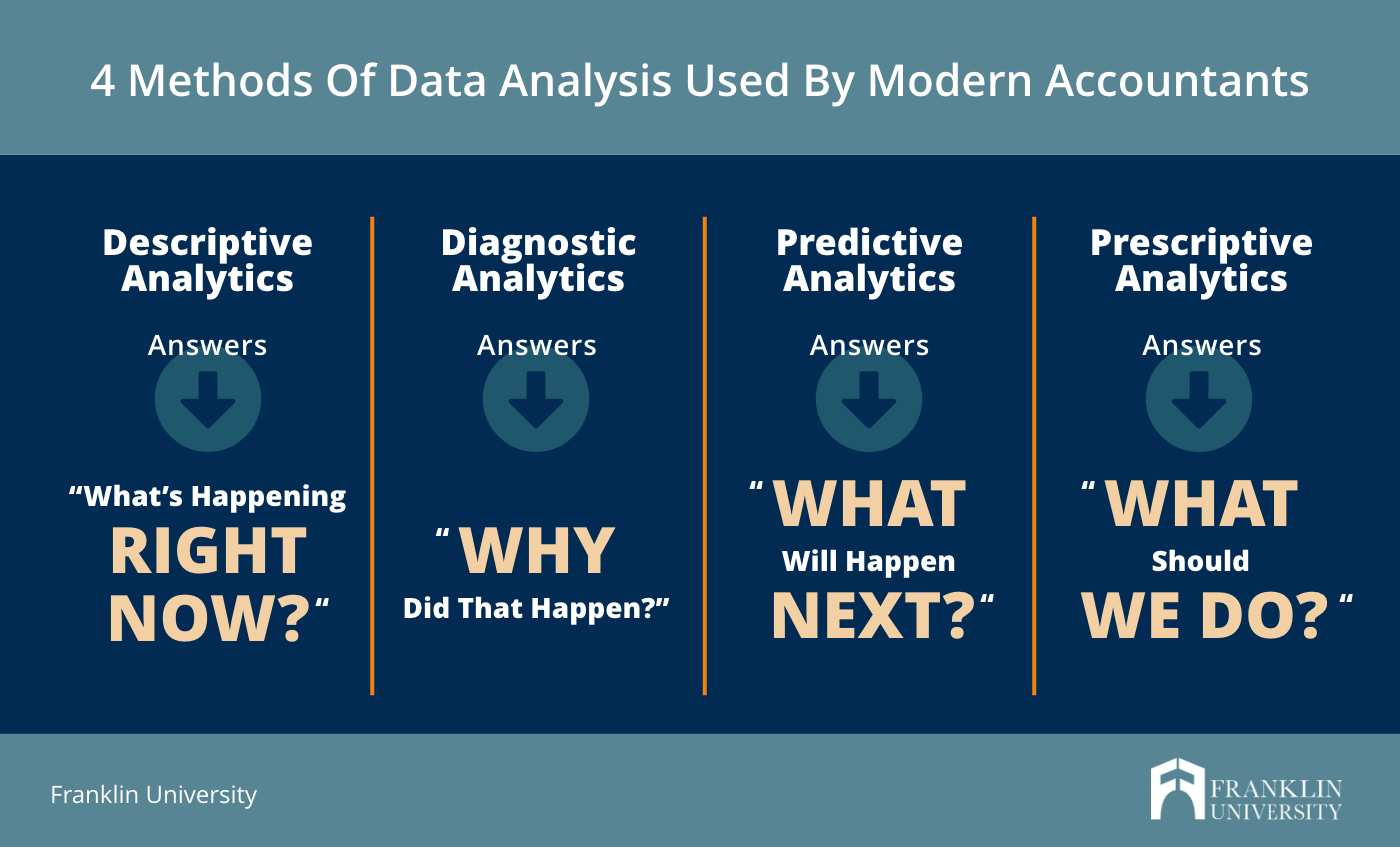

There are four types of data analysis used in accounting:

- Descriptive Analytics

- An accountant looks to answer the basic question of “What’s Happening.” In order to do this effectively, they have to take all available data points and create accurate reports that reflect the reality of the business.

- Accountants use descriptive analytics to create reports and financial statements.

- Diagnostic Analytics

- The question to be answered here is “Why.” Accountants rely on current information and historical data to provide insights and reasons for the known outcomes.

- Diagnostic analytics are used to create dashboards that are part of an examination of completed business periods.

- Predictive Analytics

- This is where accountants try to discern “What’s Next.” Accountants have long been tasked with creating business forecasts, but with access to big data they are also able to predict the patterns that drive those forecasts.

- An accountant will use predictive analytics to develop models that showcase potential business outcomes.

- Prescriptive Analytics

- Accountants don’t always just have to predict where the business will go, they can help them get there. Using data analytics, an accountant can produce fact-driven reports that can be translated into actionable steps.

- Prescriptive analytics are used when building data-supported business plans.

While accountants may choose an area to specialize in, they will most likely find themselves working across categories.

Tools for Data Analytics in Accounting

Becoming a successful accountant specializing in data analysis takes a certain amount of technical skill and critical thinking ability. You’ll need to be able to work within industry specific data analytic tools to help companies make good decisions.

It’s also extremely helpful to understand languages like Python and “R” to create custom algorithms and data models that can be used with larger sets of data.

While technical skills are important, you won’t get far without effective communication and presentation skills. It’s important to be able to properly communicate your insights in a clear, concise, and actionable manner.

As an accountant, there are different accounting tools you may be expected to use:

- Excel

Excel is a popular tool for smaller businesses. It’s easy to navigate for core accounting needs including drafting budgets, building financial statements and developing balance sheets. - Tableau

Accountants who work in larger data-sets (e.g. a mid-sized company) have found Tableau to be a strong and flexible tool. It’s particularly valued for its’ ability to visualize data. - Power BI

Power BI combines business intelligence and data visualization. It’s also a highly connected application as it easily connects with Excel, Quickbooks, Google Analytics and more so accountants can use it to aggregate multiple streams of data. - IDEA

Accountants use IDEA because it’s software that was specifically built for data analytics. Data can be easily imported and analyzed quickly, efficiently, and in a user-friendly format. - A.I. and Analytics

A.I. (Artificial Intelligence) holds powerful potential for the accounting field but when it comes to data analysis it has limitations. While A.I. systems may be able to analyze large datasets quickly, a human will still need to critically evaluate, interpret and create business plans based on that data.

Master the Data, Master Your Career

With new data points continually being generated, data analytics in accounting is an ever evolving and increasingly important field. The potential and power in data makes this an exciting and challenging time for accountants to expand their skill set.

You can get a start on meeting this challenge at Franklin University with their Accounting Data Analytics Certificate. It’s another offering from Franklin’s fully-accredited Accounting program.

Franklin has developed exceptional accounting data analytics courses at the undergraduate and graduate level. The faculty at Franklin are experts in the field of data analytics and they work with students all over the world to bring the specifics of accounting data analytics to them in a very hands-on, relevant, current and practical way.

Data is fast becoming the currency of business and there are important details and insights in it, if you just know where to look.