Career on the Rise: How to Become a Forensic Accountant

Think accountants just crunch numbers at their desk all day? Then you haven’t explored the world of forensic accounting. Forensic accountants act as financial detectives, examining questionable financial data, investigating fraud, and aiding in civil and criminal investigations.

Here’s what forensic accountants get to do every day:

- Aiding in risk management and risk reduction through financial policies and procedures

- Investigating proposed mergers and acquisitions

- Being involved in bankruptcy proceedings

- Uncovering criminal activities like fraud, embezzlement, money laundering and concealing of debt

As technology advances and fraud becomes more difficult to detect, forensic accountants will be vital to stopping financial crime. Want to prepare yourself for this exciting and fast-paced career? It takes time, dedication and professional licensure. But if you’re interested in putting your detective skills to the test to ferret out financial crime—this career is well worth it.

Step 1: Define Your Career Path

As a forensic accountant, you have the ability to play a variety of roles. Knowing the specific job you want will help you get ahead and allow you to specialize in the area you’re most interested in. As a forensic accountant you will be qualified for jobs like:

- Forensic Accountant: The tried and true job title for accountants who work to investigate and deter fraud. A forensic accountant is a certified public accountant that is able to examine financial records and accounts that could then be used as evidence.

- Fraud Examiner: Fraud examiners collect and analyze evidence that will be used in fraud investigations. They perform legal searches to examine financial information, collect evidence and interview witnesses and suspects.

- Internal Auditor: Internal auditors are dedicated to the deterrence of financial crime by examining and improving operating practices, and financial and risk management processes to ensure financial accuracy and regulatory compliance.

- Fraud and Forensic Accounting Consultant: As a consultant, you can work independently or as part of a consulting firm to apply your forensic accounting skills in a wide variety of industries and workplaces.

Depending on your education, professional experience and desired workplace, you can find jobs like these, and many others, which you'll be qualified for when you become a forensic accountant.

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

Step 2: Get a Specialized Undergrad Degree to Match

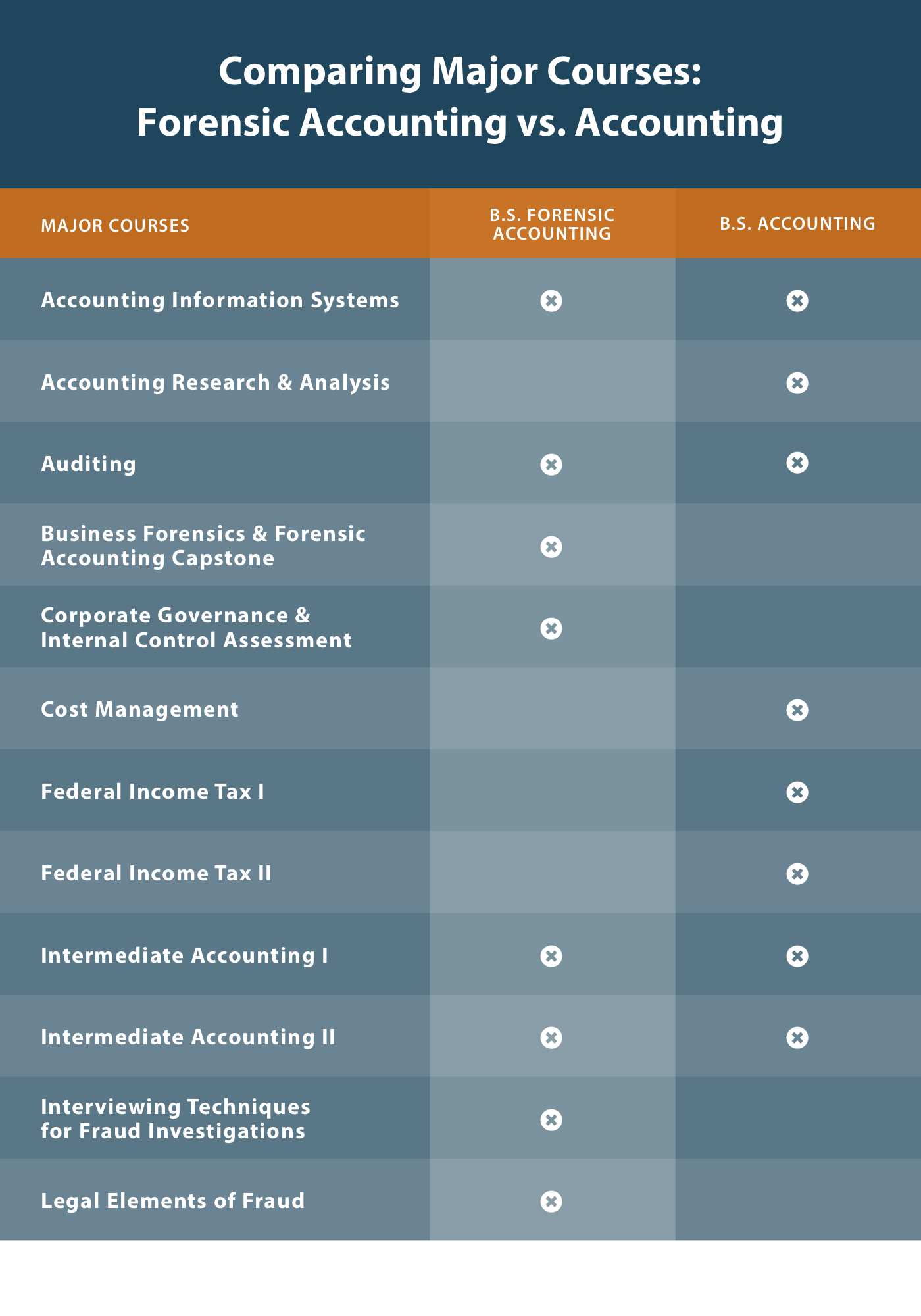

A bachelor’s degree in accounting, finance or a related business specialty, and/or a master’s in accounting are preferred by most employers. No matter which path you choose, you will need to complete a number of required accounting courses to have the credit hours and knowledge required to pass the CPA exam. Getting a bachelor’s or master’s degree in these disciplines can be a stepping stone to starting a career as a forensic accountant. However, if you’re truly passionate about fighting financial crime, there are now specialized bachelor’s and master’s degrees in forensic accounting. These programs help you gain foundational accounting knowledge to help prepare you for the CPA exam, while also diving into the ins-and-outs of financial fraud investigation. “A Bachelor's in Forensic Accounting takes your accounting knowledge to a new level,” says Dr. Charles Saunders, an Adjunct Professor of Accounting at Franklin University, “It prepares you to think like an investigator—taking your knowledge of traditional accounting procedures and using it to discover how people manipulate these processes to falsify financial information.” Look for degree programs and training that cover niche topics like:

- Fraud Examination: From examining financial documents to writing investigative reports and testifying to findings, learn the foundational aspects of a specialized role as a forensic accountant.

- Legal Issues of Fraud: These courses ensure you understand the criminal and civil aspects of fraud, as well as how to effectively collaborate with law enforcement and legal counsel.

- Fraud Prevention: Curtailing fraud starts with effective risk management and developing internal controls to deter fraud. These types of courses discuss the preventive aspects of a forensic accountant's job.

- Interviewing Techniques for Fraud Investigations: Gain insight into effective strategies and techniques for soliciting the information you need from suspects and witnesses to make a conviction.

To identify a high-quality forensic accounting program you should research an institution’s accreditation status, required coursework, faculty and teaching practices to ensure they are up-to-date with real-world job requirements. You should also make sure that the program you pursue completes the prerequisites for the CPA exam in your state if you plan to become a licensed accountant.

Step 3: Earn Your CPA

There are two primary licenses or certifications you can get to pursue a career in financial fraud prevention: Certified Public Accountant (CPA) and Certified Fraud Examiner (CFE). Let’s dive into the difference between these two designations. Certified Public Accountant (CPA) A CPA is a state license to practice accounting. While not all accountants are CPAs, it’s the gold standard of accounting designations and a job requirement for most organizations. To become a CPA, you must meet specific education, examination and experience requirements. The first step is meeting the educational requirements outlined by your state. Then, you can sit for the CPA exam. The CPA exam is extremely rigorous, ensuring professionals meet the highest standards for both educational and ethical practices as an accountant. To prepare for the CPA exam you should:

- Take the CPA exam when the content is fresh in your brain. Don’t wait too long to start taking the exam—it includes four parts that must be completed within 18 months.

- Know the content of each section and how it will be tested. The format and functionality will vary by section, so be sure to take practice tests to prepare.

- Study. Study. Study. Make sure you set aside dedicated and uninterrupted time to prepare for the exam.

- Start with the content you’re most familiar with. Gain confidence by passing that section first.

- Build a support network. Whether that’s finding people to study with, a mentor who can help you navigate the process or an exam partner to help you prepare.

Once you pass the exam, you must meet professional experience requirements in order to be granted your license.

Step 4: Become a Certified Fraud Examiner (CFE)

Certified Fraud Examiner (CFE) Another route, which can be pursued as a single designation or in tandem with a CPA, is CFE certification. A CFE shows proven expertise in fraud prevention, detection and deterrence. CFEs are trained to understand complex financial transactions, recognize the warning signs that indicate fraud or fraud risk and know the methods for resolving fraud allegations. Here’s how you can get certified:

- Join the Association of Certified Fraud Examiners (ACFE): You must be a member of ACFE to take the exam and earn your CFE credential.

- Prepare for the CFE Exam: Become an expert on the Fraud Examiners manual and take online or in-person study courses

- Apply for the CFE Exam: Complete your application and submit your application fee to take the exam

- Pass the CFE Exam: The CFE Exam tests your knowledge and expertise in the four primary areas of fraud examination: Financial Transactions & Fraud Schemes, Law, Investigation, and Fraud Prevention & Deterrence.

Becoming a CFE can have a direct impact on your earnings potential. According to the ACFE, the median salary for a CFE is $104,500, while the median salary for a non-certified fraud examiner is only $82,938. Do I Need Both a CPA and CFE? That depends on your career goals. The CFE certification does not qualify you to be a licensed accountant, but does prepare you for a career as a fraud examiner. If you want to be a practicing accountant who specializes in fraud, both the CPA and CFE may be right for you. Combined, these two designations can be a powerful way to demonstrate expertise and differentiate yourself among job candidates.

Step 5: Find a Job in an Environment You’ll Like

Forensic accountants work across the public, private and nonprofit sector. Some of the most common employers for forensic accountants are:

- Government departments like the FBI, CIA and IRS, as well as state and local government

- Law firms

- Accounting firms

- Banking, brokerage, insurance and other financial-services industries

- Corporate security and risk management companies

- Financial consulting firms

If you’re looking for a job as a forensic accountant, start by identifying which type of employer interests you most. Often, the best place to look for these jobs is directly on an organization’s website. Other resources include the ACFE Job Board, AICPA Career Center and USAJobs, the federal government’s jobs website.

Professional experience is a huge differentiator when it comes to hireability and salary expectations for forensic accountants.

*Robert Half 2019 Accounting and Finance Salary Guide

In addition to work experience, you should also look to join professional organizations like the American Institute of CPAs (AICPA) and the Association of Certified Fraud Examiners, which provide ongoing education, networking opportunities and career guidance.

Start Your Journey to Becoming a Forensic Accountant Today

Take the next step to fulfilling your dream of becoming a forensic accountant by finding the right program for you. Choosing a program that specializes in the intricate details of forensic accounting can give you a leg up as you start your career.

Explore the Franklin University Bachelor’s in Forensic Accounting to see how our flexible, online curriculum can give you job-ready skills—without taking time out from your career.