CMA Certification Requirements: Everything You Need To Know

Accounting is a fast-growing and in-demand career path that provides many opportunities for advancement. According to the Bureau of Labor and Statistics, accountant and auditor employment will grow 7% from 2020 to 2030. However, many candidates discover they need advanced certifications to climb the ladder of success. The good news is that past education and work experiences may be enough to pass some certification exams. However, others require additional training, like the Certified Management Accountant, or CMA.

This article provides the necessary information any CMA candidate needs to earn certification and advance their career.

What is a CMA Certification?

A CMA certification is a professional credential for management accounting and financial management fields.

The certification signifies an individual knows the areas of financial planning, analysis, control, decision support and professional ethics. It's issued by the Institute of Management Accountants (IMA) and is considered the global benchmark for management accountants and financial professions.

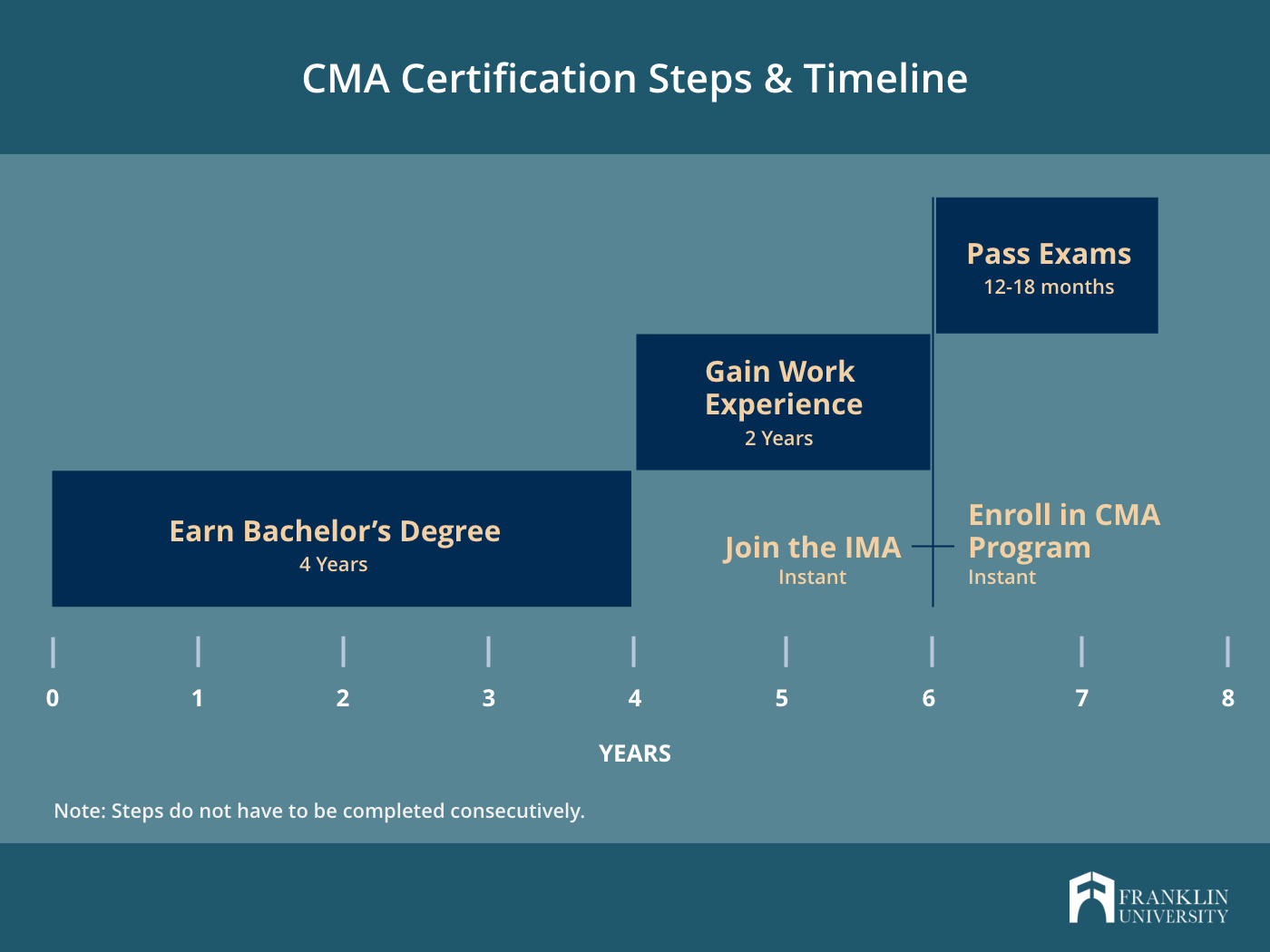

It takes most candidates 12-18 months to complete the program, which encompasses two parts: Financial Planning, Performance and Analytics, and then Strategic Financial Management.

"The certification process is rigorous, but for a good reason. Management accounting professionals with CMA certification have a more diversified knowledge base, making them more specialized than a general accountant," said Annette Hoelzer, MT, CPA, Lead Faculty of Accounting at Franklin University. "They often work alongside upper management to help in making key planning decisions, and it's not uncommon for individuals who've earned a CPA also to obtain a CMA."

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

What are the Requirements to Earn a CMA?

A CMA certification demonstrates that an accounting professional has mastered the 12 most critical practice areas of management accounting. As such, the process to earn such designation is rigorous. These are the steps that must occur to earn and maintain a CMA.

- Join the IMA: The IMA administers the CMA exam. Being an "active member" requires a $245 membership fee.

- Enroll in the CMA program: Enrolling in the program requires a $280 fee to the CMA, which writes and grades exams and notifies employers about applicants who complete the program.

- Meet education requirements: Candidates must earn a four-year degree from an accredited college or university. Although the CMA certification is based in the United States, degrees from any country are accepted if accredited. The education requirement does not need to be completed before enrolling in the CMA program.

- Meet experience requirements: Candidates must have at least two continuous years of full-time work experience or work part time at least 20 hours per week. The experience requirement does not need to be completed before enrolling in the CMA program; however, candidates must complete the experience requirement within seven years of passing the CMA exam. The IMA has specific rules for continuing work experience, so it's important to validate which experiences qualify.

- Pass both parts of the CMA exam: The exams are split into two parts taken separately in any order, and each exam has a $460 fee. Part 1 covers financial reporting, planning, performance and control. Part 2 covers financial decision-making and strategic planning and management. Applicants have three years to complete both parts of the CMA exam. Failure to complete the exam requires re-enrollment in the CMA program.

- Participate in continuing education: Each year, CMAs must complete 30 hours of continuing professional education (CPE), with at least 2 of those hours in ethics. The IMA standards of ethical practice include competence, confidentiality, integrity and credibility. This requirement doesn't apply until after a candidate has passed both parts of the CMA exam.

To maintain your certification you will need to complete 30 hours of continuing education courses per year. At least two hours must be in the area of ethics. You will also need to pay both your IMA membership and CMA maintenance dues each year.

Why Earn a CMA Certification

Earning a CMA certification can open new doors, particularly for management accountants who want to work more closely with C-suite executives.

- Be In Demand: Leaders respect the certification as it gives accountants the ability to make educated decisions about the company's planning.

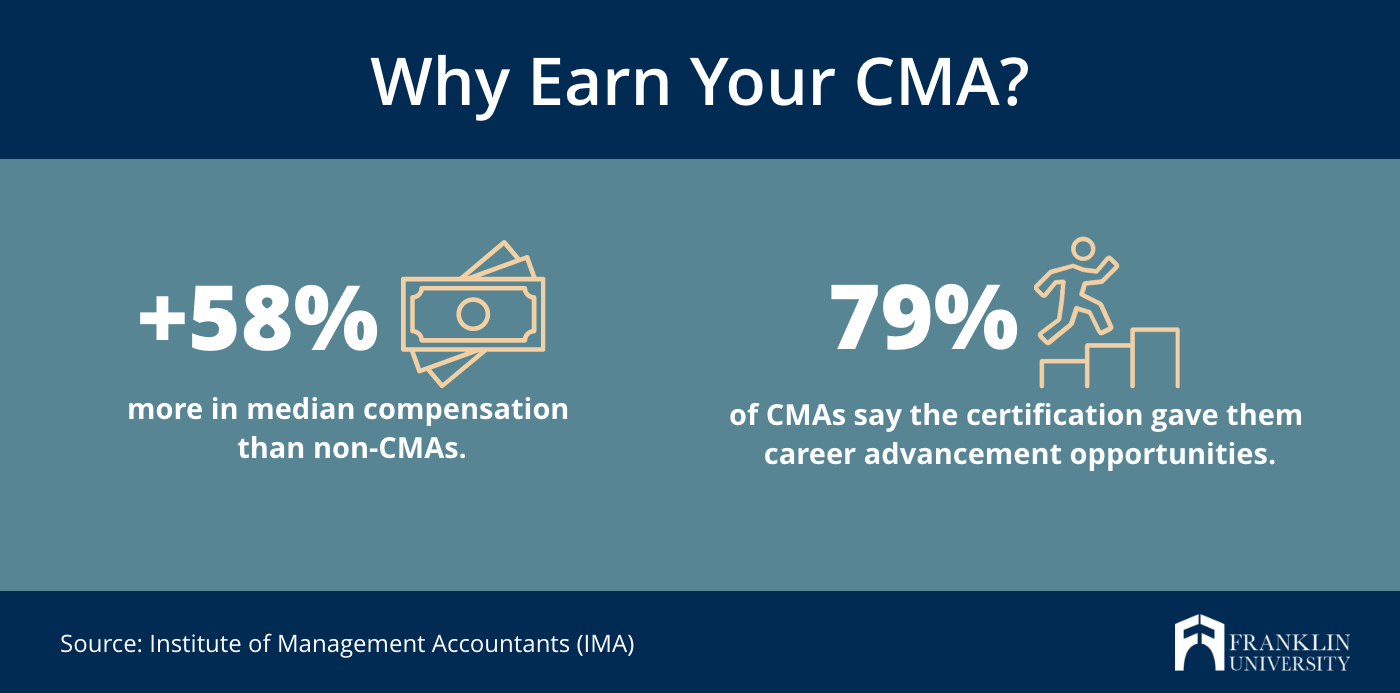

- Increased Salary: Upper-level positions present opportunities for increased base salary. According to IMA, CMAs earn 58% more in median total compensation than non-CMAs.

- Career Opportunities: Earning a CMA certification leads to promotions and new positions. According to the 2021 IMA Global Salary Survey, 79% of respondents said the certification gave them career advancement opportunities.

- Global Recognition: CMA certification is a globally respected and internationally recognized certification, creating opportunities at multinational companies.

- While earning a CMA certification presents many valuable opportunities, it doesn't mean it's a winning strategy for everyone.

"It's ideal for management accountants, but it may not be a valuable investment for someone in public accounting or if they have no desire to advance in the profession," said Hoelzer. "However, someone transitioning from public accounting to industry accounting is well advised to pursue the certification."

Advance Your Career Today

Management accountants who want to close their skills gap and create opportunities to advance in their profession should consider enrolling in a CMA program and seek learning support. Franklin University offers undergraduate and graduate courses that encompass topics covered on the exam plus a significant amount of experiential learning. To enroll in the CMA program, visit www.Imanet.org and select CMA certification.